IPOs are like the debut of shares in the stock market similar to an actor making a debut in a film for the first time. This debut decides the fate of the actor. If the film becomes a blockbuster, he will be seen in upcoming films, with hiked pay. If the film flopped, then probably he will have to struggle to get himself even an ad film. IPOs are offered to investors by the companies to raise funds, whereas investors invest in IPOs with the intent of earning on the appreciated market price of the shares when they get listed in the stock exchange either in the short term or long term. Investors who subscribe to the IPO may or may not get the shares, especially when the IPO is oversubscribed. The investors need to check the IPO allotment status to know if they were successfully allotted the share lot applied for or not.

Table of Contents

What is an Initial public offer (IPO)?

When an unlisted company makes either a fresh issue of securities or offers its existing securities for sale or both for the first time to the public, it is called an IPO. In other words, when the company’s share makes its first debut in the share market is called an IPO. The success or failure is dependent on the company’s business model and its ability to capture the market which will finally reflect in the market share price. IPO paves the way for the listing and trading of the issuer’s securities on the Stock exchanges.

How to apply for an IPO and get an IPO allotment?

Applying for an IPO has been made easy through online mode. You need to have a Demat account to apply for an IPO. Once you have opened a Demat account you need to ensure you have the minimum amount for an IPO lot size in your bank account. Usually, it is Rs 15000/- however, it might differ in some cases. Then you may bid for the IPO through an online Demat account. Once applied for IPO, the amount will get blocked in your bank account unless the allotment is finalized. If you get the allotment of shares the same amount will get deducted from your bank account.

In India, Zerodha is the lowest-cost stockbroker with the least transaction charges and various benefits. It offers unmatched prices as below:

- Free equity delivery – no cost at all

- Intraday and F&O trades – Flat Rs. 20 or 0.03% (whichever is lower) per executed order on intraday trades across equity, currency, and commodity trades.

- Free direct MF – All direct mutual fund investments are free — ₹ 0 commissions & DP charges.

Steps for applying for IPO by Zerodha:

- Open Demat account- here it is Zerodha

- Login to your account

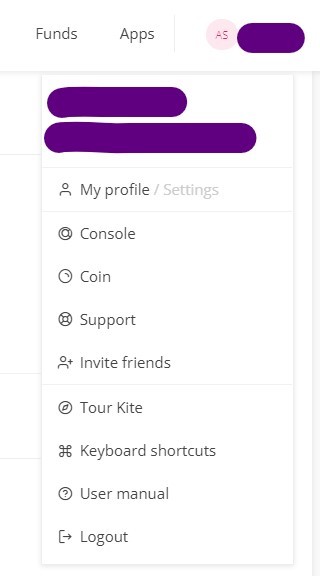

- Go to the right-hand side of your profile icon, click on it to get a dropdown list as below, and select the console

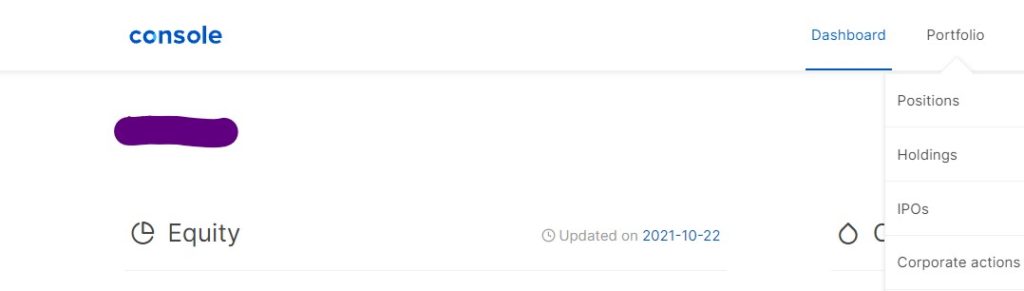

- On console — Click at Portfolio —Click at IPO

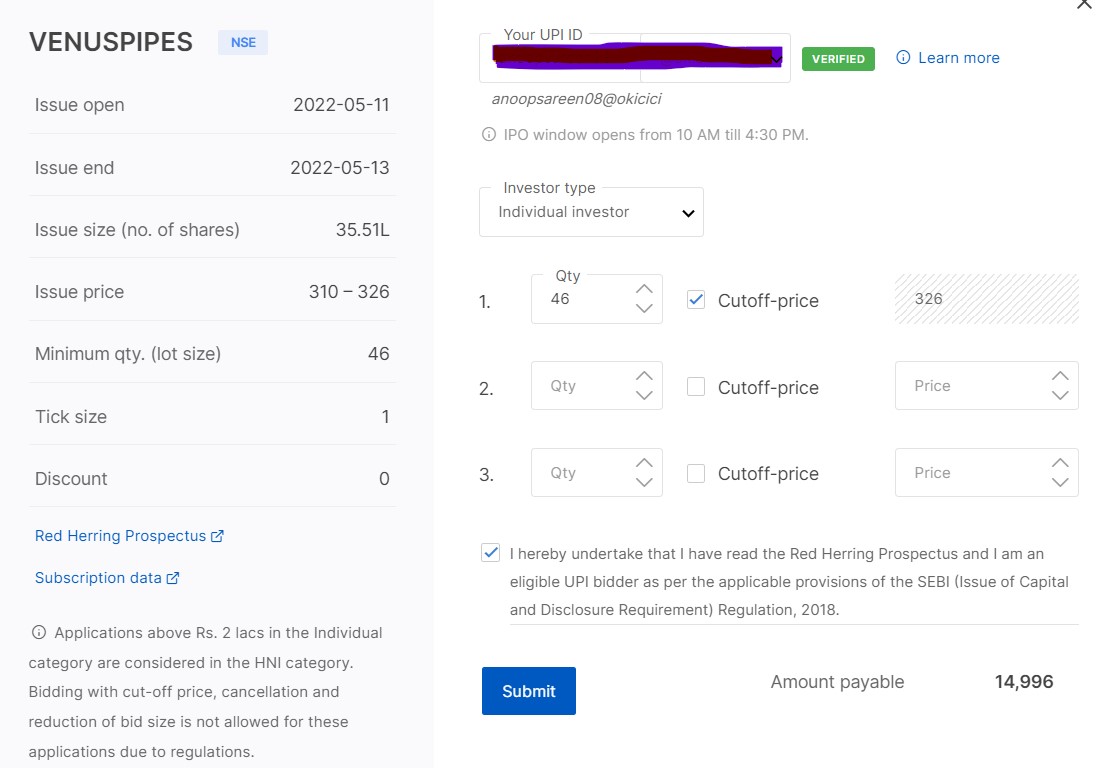

- The Active IPOs will have the Apply option highlighted in blue. If you want to apply, click on the option, and the below screen will populate

- You need to fill in the minimum quantity of shares mentioned as well as tick the cut-off price mentioned below

Thus you have applied for the IPO, now wait for the allotment.

Who decides IPO allotment?

The IPO registrar is responsible for finalizing the allotment based on guidelines prescribed by SEBI. IPOs are shares offered by a company to investors. The minimum number of shares forming 1 lot, and price is mentioned while applying IPO. The percentage of share allocation is pre-decided for Qualified Institutional Buyers (QIBs), Non-Institutional Investors (NICs), and Retail Individual Investors (NICs). Now there could be 2 possibilities:

- Under subscription of shares

The number of bids or applications was less than the number of shares lots to be offered. In this case, the IPO allotment becomes easy as each subscriber gets a percentage of shares.

- Oversubscription of shares

The number of bids or applications was more than the number of shares lots to be offered. In this case, the IPO allotment will be done based on a lucky draw, where randomly a subscriber will be chosen from the list of applications, and the shares will be allotted.

How to check IPO allotment status?

If you get the allotment of shares the same amount will get deducted from your bank account. The amount will get blocked in your bank account unless the allotment is finalized.

IPO Allotment Status can be checked using the below ways:

1.) Bank notification or amount deduction

The best and most genuine way is to sit back and relax, till the allotment date is finalized and shares get allotted. Sometimes the bank gives notification of the amount of IPO (usually Rs 15000/- approx.) deducted from your bank account. If the amount gets deducted from your bank account, then be assured that you have been lucky to get an IPO allotment. On the other hand, if you end up getting a notification from your bank, that the amount of IPO so blocked has been revoked, or unblocked, then you have not been successful in getting an IPO allotment.

This is the most legitimate way of checking IPO allotment status.

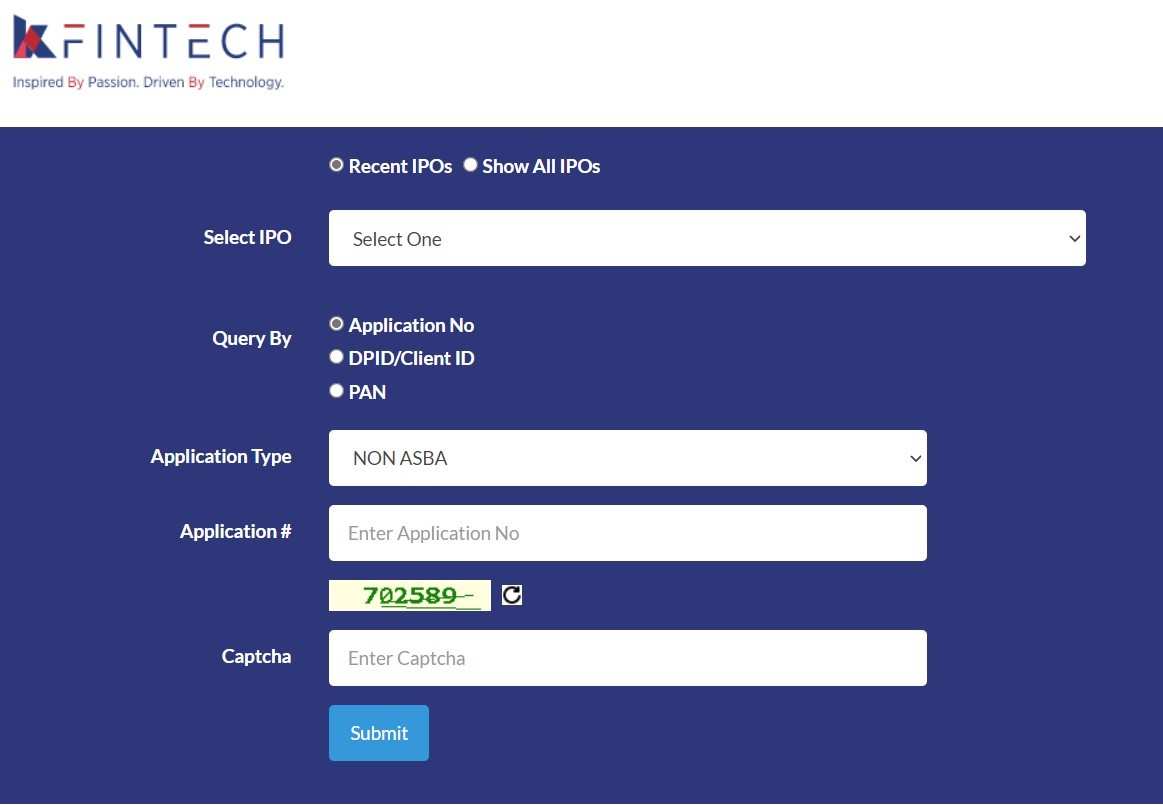

2.) KFIN Technologies

Click on the below link:

https://ris.kfintech.com/ipostatus/ipos.aspx

- Choose IPO allotment to check the status

- Choose the IPO name

- You may input either Application number/DPID or client ID/PAN

- The best among the above 3 is the PAN number

When you submit the details, you will be able to check the IPO allotment status

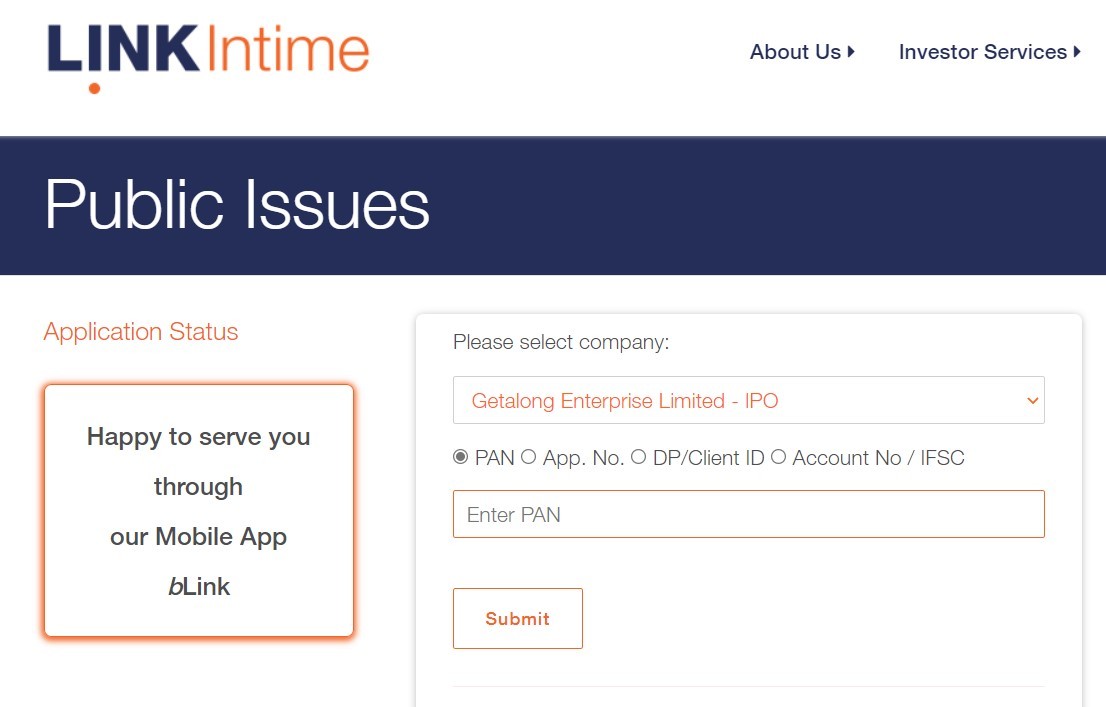

3.) Link Intime India

Click on the below link:

https://linkintime.co.in/IPO/public-issues.html

- Choose the company’s IPO name

- You may input either Application number/DPID or client ID/PAN/ Account No or IFSC

- The easiest among the above 3 is the PAN number

When you submit the details, you will be able to check the IPO allotment status.

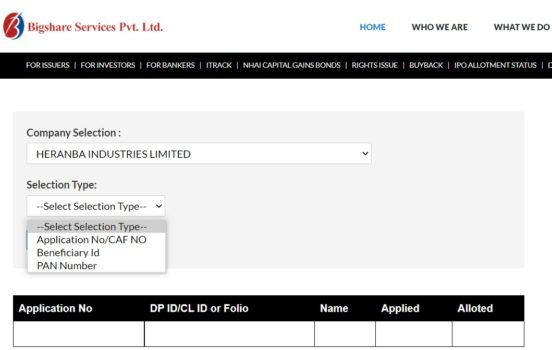

4.) Bigshare Services

Click on the below link:

https://www.bigshareonline.com/BSSIPOApplicationStatus.aspx

- Choose the servers, choose any out of three

- Choose the company’s IPO name

- You may input either Application number/Beneficiary ID/PAN number

When you submit the details, you will be able to check the IPO allotment status.

If Applied through Paytm UPID- then on the Paytm Money App You will get a notification of allotment. Going forward, you can also check the status on the link provided by Paytm Money on your application. In Paytm Money’s IPO section, you can click on view IPO orders and check the IPO allotment status by clicking on the IPO application.

How to increase your chances of getting an IPO allotment?

If you think the IPO is worth investing in, then to increase your chances of getting the IPO, apply through the Demat accounts of all your family members. Remember one Demat account linked with one Pan ID is applicable for applying to an IPO. Even if you have 2 Demat accounts, that does not make you eligible to apply twice for an IPO. This will result in the rejection of your application.

Why should you check the IPO allotment status?

Checking IPO allotment status is a crucial step for investors who have applied for shares in an Initial Public Offering (IPO). It provides valuable information about whether their application for shares has been successful or not. Here’s why checking IPO allotment status is important and how it can be beneficial:

1. Confirmation of Allotment: The primary reason to check the IPO allotment status is to confirm whether you have been allotted the shares you applied for. This information helps you know if your investment in the IPO has translated into actual ownership of shares in the company.

2. Financial Planning: Once you know the number of shares you’ve been allotted, you can adjust your financial plans accordingly. You’ll be able to calculate the total value of the shares allotted and consider them as part of your investment portfolio. This information is vital for managing your overall financial strategy.

3. Investment Decision Making: Knowing your IPO allotment status empowers you to make informed investment decisions. If you’ve been allotted the desired number of shares, you can decide whether to hold onto them as a long-term investment or sell them if you believe there’s a short-term opportunity for profit.

4. Portfolio Diversification: IPO investments can play a role in diversifying your investment portfolio. If you’ve been allotted shares in an IPO, it could be a way to diversify your holdings beyond your existing investments in stocks, bonds, or other assets.

5. Profit Potential: Checking the IPO allotment status helps you gauge the profit potential of your investment. If you’ve been allotted shares at a lower price than the market price after listing, you may have the opportunity to sell them at a profit immediately or at a later date.

6. Tax Planning: Understanding your IPO allotment status is important for tax planning. The gains or losses you make from selling the allotted shares may have tax implications, and being aware of your allotment status enables you to prepare for potential tax liabilities.

7. Risk Assessment: If you applied for shares in multiple IPOs, checking the allotment status helps you assess your overall risk exposure. You can compare the shares you’ve been allotted with your allocation strategy and decide whether any adjustments are needed.

8. Communication with Brokers: In some cases, brokers might need information about your allotment status to facilitate the settlement process. Being aware of your allotment status allows you to communicate effectively with your broker and ensure smooth processing.

9. Transparency and Clarity: Checking the IPO allotment status adds transparency to the IPO process. It ensures that you are aware of the outcome of your application and reduces uncertainty.

10. Investor Confidence: Being updated about your IPO allotment status boosts your confidence as an investor. It helps you stay engaged with the investment process and demonstrates your commitment to making informed financial decisions.

In summary, checking IPO allotment status provides you with critical information about the outcome of your investment in the IPO. This information has significant implications for your financial planning, investment decisions, portfolio diversification, and overall investment strategy. It helps you stay informed, make informed choices, and effectively manage your investments.

FunFact:

Currently, IPO investors are divided into three board categories. The first one is institutional investors, who have a reservation of 50 percent of the shares sold in the IPO (75 percent in case the IPO is by a company that doesn’t meet the profitability track record). Sebi has sought market feedback as to how the HNI bucket should be a further dividend. The regulator has also proposed to tweak the allotment methodology for the HNI category from a proportionate basis at present to draw lots. The regulator will take a final call on the proposed changes based on market feedback.

Have you checked the IPO allotment status?