Should you subscribe to Devyani International Limited IPO? It will be out on August 4th, 2021, and closes on August 6th, 2021. Below are some of the important dates and details

| IPO Details | Dates |

| IPO open date | August 4, 2021 |

| IPO close date | August 6, 2021 |

| Price band | Rs 86-Rs 90 |

| Minimum lot quantity | 165 |

| Allotment date | August 11, 2021 |

| IPO listing date | August 16, 2021 |

Table of Contents

Background & Business- Devyani International Limited IPO

Devyani International Limited is a leading franchisee of Yum Brands in India. It operates under brands of KFC, Pizza Hut & Costa Coffee in India. As of 2021, it operates 655 stores across 155 cities in India. Yum! Brands Inc. operates brands such as KFC, Pizza Hut, and Taco Bell brands and has a presence globally with more than 50,000 restaurants in over 150 countries, as of December 31, 2020.

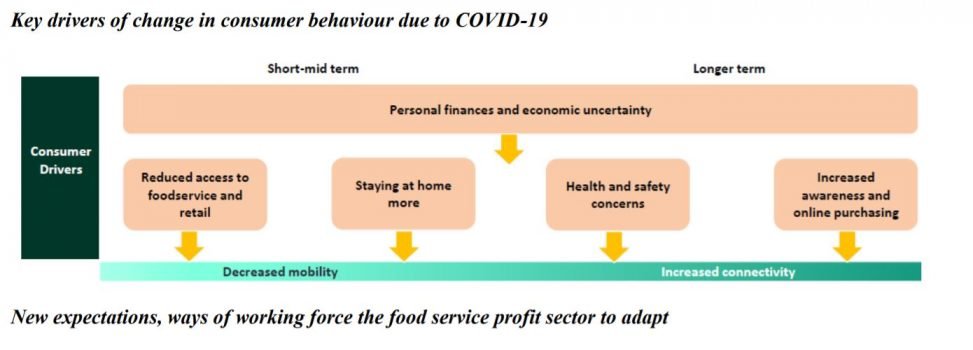

COVID Impact on Business

The pandemic had a two-way impact, whereas it has increased demand for food delivery but on the other hand, witnessed a significant decline in in-store dining due to lockdowns and other restrictive government measures imposed by the central and state governments from time to time. Restrictive government measures including the standard operating procedures issued by the Government of India that limit utilization of restaurant capacity to 50% affected this industry. As a result, revenue generated from in-store dining represented 48.85% of revenue from operations of their Core Brands Business and declined to 29.80% of our revenue from operations of their Core Brands Business in 2021.

Forecasted Growth

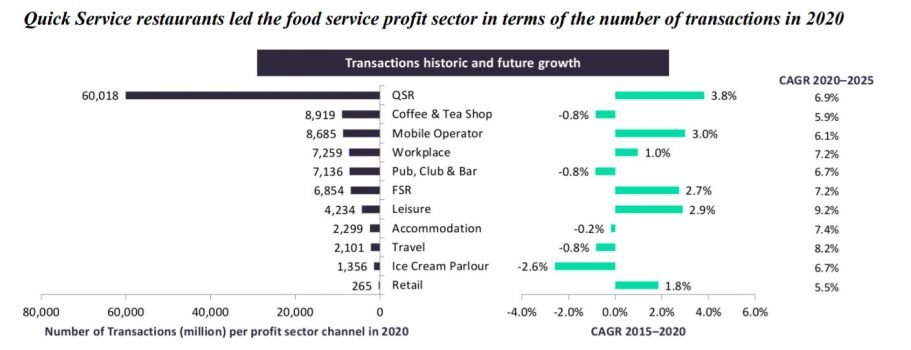

The Indian food services profit sector generated total revenue of ₹8,366.6 billion (US$117.5 billion) in 2020, growing at a CAGR of 1.9% from ₹7,601.4 billion (US$118.5 billion) in 2015. Growth was mainly driven by the rise in the number of transactions, which grew at a CAGR of 2.4%, during the same period. The number of transactions is expected to grow by an even higher rate of 6.9% in the period between 2020 and 2025. While both dine-in and take-away/ delivery transactions are expected to grow during this period, deliveries are projected to grow at a higher rate compared to dine-ins. Growth in the quick service restaurant (“QSR”) channel, supported by urbanization and increasing exposure of the youth to these food types, is expected to play a key role in the overall growth of the foodservice industry. The total foodservice revenue is expected to grow to ₹17,220.3 billion (US$219.4 billion) in 2025, registering a strong CAGR of 15.5% from 2020 to 2025.

Reasons for forecasted growth:

- Urbanization

- Exposure to different types of food

- Increased demand for eating out

- Increased demand for food delivery through online apps

Financial Highlights & trends (2019-2021)

- Cash Balance – Total cash balance increased by 48% in 2021 vs in 2019

- Total Equity also increased by 159% in 2021, in fact it was negative till 2021, this year it has turned positive

- Borrowings increased slightly by 8%

- Total Revenue reduced by 9%, mostly due to covid

- Total Expenses reduced slightly by 4%

- Loss after tax reduced by 41 %

- Cash Flow from operations witnessed slight dip but it has been positive all 3 years

Below are inferences:

- Company’s revenue dropped due to corona, but its expenses did not reduce at the same pace

- Company borrowings have reduced, reducing its fixed expense obligation

- Surplus cash always helps in absorbing any shocks or meeting emergency situations

- Cash Flow from operations has been positive in all 3 years, but focus should be on improving cash flow from investing activities which is still in negative, though cash flow from financing activities has turned positive in 2021.

- Leasing facilities have reduced since demand for dine ins have reduced

Devyani International Limited IPO- Subscribe or Not?

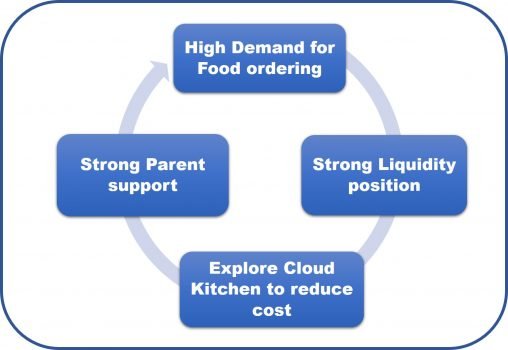

Yes, We recommend you to subscribe to Devyani International IPO. Looking at its promising growth forecasts, strong Parent background, and ok financials.

Stock Market Tip– Do subscribe to Devyani International Limited IPO.

Strengths of Devyani International

- Growing demand for food chains offering different types of food & food delivery

- Supply chain interruptions on account of the COVID-19 crisis due to closed stores

- Strong Liquidity position – derives support from the financial & liquidity profile of RJ Corp owing to the guarantee given by RJ crop for its rated facilities

- Strong Parent background & support

- Explore options of cloud kitchen post covid to reduce operational cost- It not offer inrestaurant services and only serve food through delivery aggregators, requiring less capital expenditure to offer food services.

Challenges of Devyani International

- Strong competition from established Quick Restaurant service competitors in the market

- Foreign currency exchange risk

- Covid-19 situation led to reduced dine-ins

- Regulatory risks due to change of any government regulations abroad or in India since they have to strictly be compliant to all the regulatory food inspections and audits.

The strengths listed overweighs the challenges called out. Thus, we highly recommend subscribing to Devyani International Limited IPO.

Short term or Long-Term Hold

We recommend holding Devyani International Limited IPO shares for the long term. As demand for Indian food service increases the demand for these Quick Service restaurants will also spike. Thus, holding for the long term will help you multiply your money. These shares also look good from receiving Dividends. Holding these for the short term might only give you listing gains.

We recommend you enroll in our Stock broker trading course which will help you to pick the rewarding IPO and earn huge profits.

Disclaimer – Investing in the stock market is subject to market risk, thus kindly consult your financial advisor before investing.

Link to annual report –https://www.sebi.gov.in/filings/public-issues/may-2021/devyani-international-limited_50136.html

Buy Smart Bulb Compatible with Amazon Alexa and Google Assistant with 16 Million colors