We have a different set of clothes for different situations. Example- vibrant color clothes for birthday parties, whereas subtle clothes for someone’s funeral. Nightdress while going to bed whereas formal dress in the office. Similarly, there are different types of Share Capital suited for specific purposes.

For easy remembrance-Mnemonic will be AISCPEP– “Awesome Ice shake of color pink made easily with pepper.”

Table of Contents

7 Types of Share Capital are:

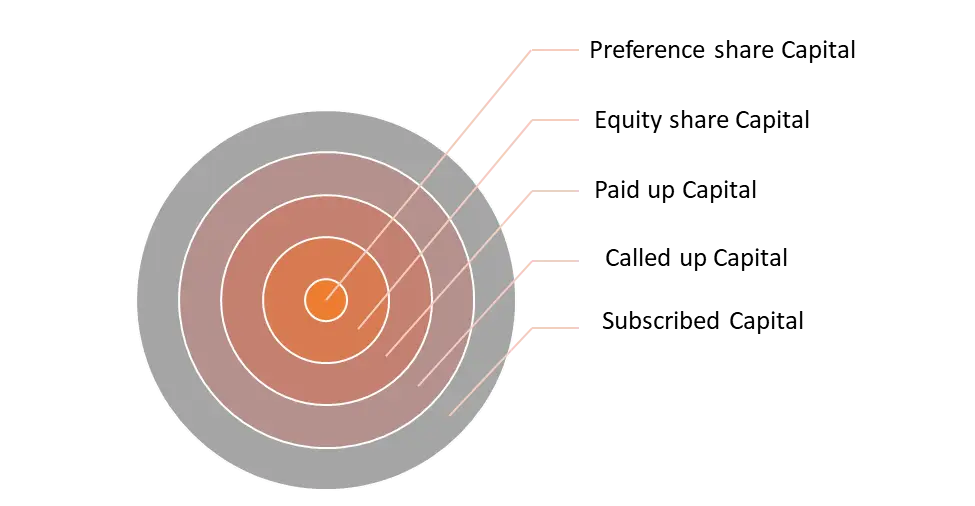

There are different types of share capital that a company raises to meet its financial needs. these types of share capital are split up into 7 types, but all actually are part of the same pie, which when cut into pieces gets a separate name. Let us know what are these 7 types of share capital in detail:

Authorized or Registered Capital

It is the maximum amount that the company may raise by issuing the shares and on which the registration fee is paid. It is the amount mentioned in the capital clause of the Memorandum of Association. This limit cannot be exceeded unless the Memorandum of Association is altered.

Issued capital

It is that part of the authorized capital which has been offered for subscription to members.

Subscribed capital

Is that part of the issued capital at nominal or face value that has been subscribed by the purchaser of shares in the company and which has been allotted.

Called-up capital

Is the total amount of called-up capital on the shares issued and subscribed by the shareholders on the capital account.

For example- if the face value of a share is Rs. 10/- but the company requires only Rs. 2/- at present. It may call only Rs. 2/- now and the balance Rs.8/- at a later date. Rs. 2/- is the called up share capital and Rs. 8/- is the uncalled share capital.

Paid-up capital

It means the total amount of called up share capital which is actually paid to the company by the members

Equity Share Capital

It is that part of the share capital of the company which determines the net worth of the company & is not preference shares.

Preference Share Capital

Those shares which fulfill the following 2 conditions-

- Preferential rights in respect of dividends at a fixed amount or a fixed rate. It means that the dividend payable is payable at a fixed amount or percentage. Also, it must be paid before the holders of the equity shares can be paid dividends.

- Having preferential right in regard to payment of capital on winding up or otherwise. The amount paid on preference share must be paid back to preference shareholders before anything is paid to the equity shareholders.

In other words, preference share capital has priority both in repayment of dividend as well as capital. Thus a share that does not fulfill both these conditions is an equity share.

Thus above explains the different types of share capital and their purpose in detail.

FunFacts

In 2020 Saudi Arabian Oil Company (Saudi Aramco) is the one with the largest market capitalization in the world valued at $1,684 Billion.