Should you subscribe or avoid LIC IPO? LIC popularly called as Life Insurance Corporation of India is getting its IPO out. It will be out on May 4, 2022, and closes on May 9, 2022. Below are some of the important dates and details:

| LIC IPO Details | Dates |

| IPO open date | May 4, 2022 |

| IPO close date | May 9, 2022 |

| Price band | Rs 902 – Rs 949 |

| Minimum lot quantity | 15 |

| Allotment date | May 12, 2022 |

| IPO listing date | May 17, 2022 |

Table of Contents

Purpose of usage of LIC IPO funds:

Below are the ways how the company intends to use the proceeds from IPO.

- Offer for Sale – The existing shareholder (Government of India) will receive the proceeds from selling their shares to the public.

Background & Business – LIC:

LIC is a household name, we bet that one member of the family will surely have at least one LIC policy in its name. LIC has been providing life insurance in India for more than 65 years and is the largest life insurer in India It is the fifth-largest life insurer globally by GWP and the largest player in the fast-growing and underpenetrated Indian life insurance sector;

LIC ‘s business comprises:

- 1% market share in terms of premiums (or GWP),

- 2% market share in terms of New Business Premium (or NBP),

- 6% market share in terms of the number of individual policies issued

- 1% market share in terms of the number of group policies issued for Fiscal 2021,

- 55% of all individual agents in India as of March 31, 2021

LIC’s products comprise (i) participating insurance products and (ii) non-participating products, which include (a) savings insurance products; (b) term insurance products; (c) health insurance products; (d) annuity and pension products; and (e) unit-linked insurance products.

Channel distribution platform consists of (i) individual agents, (ii) bancassurance partners, (iii) alternate channels (corporate agents, brokers, and insurance marketing firms), (iv) digital sales (through a portal on our Corporation’s website), (v) Micro Insurance agents and (vi) Point of Sales Persons-Life Insurance scheme.

COVID Impact on Business –

Covid-19 impacted Life insurance business operations especially when lockdown became operational during the first wave. Since the majority of their sales came from agents’ personal contacts, were temporarily disrupted due to lockdowns. The expansion plans were kept on hold for the conditions to improve. Though the insurance business was impacted LIC adapted digitalization to keep its business running.

Growth in new business premium in the first quarter of Fiscal 2021 declined year-on-year as lockdowns disrupted operations. The life insurance industry, which mainly depends on in-person interaction, has adopted more digital ways of selling products and services in the past year amid the pandemic. In Fiscal 2021, amid the COVID-19 pandemic, NBP grew by approximately 7.5% to Rs. 2.78 trillion compared to Rs. 2.58 trillion in Fiscal 2020.

Below were some of the initiatives taken by LIC during covid-19

In Fiscal 2020, LIC GJF contributed ₹50.00 million to the PM CARES Fund, ₹10.00 million to the Chief Minister’s Relief Fund for COVID-19 – Government of Maharashtra, and ₹5.00 million to the International Association for Human Values’ disaster relief fund for COVID-19 relief.

- In Fiscal 2021, LIC GJF sanctioned a ₹10.00 million donation to Tata Memorial Hospital for the treatment of COVID-19 affected cancer patients.

- In Fiscal 2020, LIC contributed ₹1,000.00 million towards COVID-19 relief efforts on a consolidated basis.

- LIC implemented several relief measures for our customers, including granting a grace period until May 31, 2020 for policies for payment of premiums due in March 2020 and relaxing some rules in relation to the settlement of maturity, survival benefit, death claim, and annuity.

Government incentives

- Pradhan Mantri Jan Dhan Yojana (PMJDY) – This scheme, launched in August 2014, is aimed at ensuring that every household in India has a bank account that can be accessed from anywhere and be used to avail all financial services such as savings and deposit accounts, remittances, credit and insurance affordably

- PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana) – This scheme, launched in May 2015, is aimed at creating a universal social security system, targeted especially at the poor and underprivileged. PMJJBY is a one-year life insurance scheme, renewable from year to year that offers a life cover of Rs. 0.2 million for death due to any reason and is available to people in the age group of 18 to 50 years (life covers up to 55 years) at a premium of Rs. 330 per annum per member. This scheme is offered/administered through LIC and other Indian private life insurance companies.

- PMSBY (Pradhan Mantri Suraksha Bima Yojana) – This scheme, launched along with PMJJBY in May 2015, is aimed at creating a universal social security system, targeted especially at the poor and under-privileged. PMSBY is a one-year accidental death and disability insurance cover, renewable from year to year that offers accidental death and full disability cover of Rs. 0.2 million (Rs. 0.1 Million for partial disability). This cover is available to people in the age group of 18 to 70 years at a premium of Rs. 12 per annum per member.

Forecasted Growth

Based on life insurance premiums, India is the tenth-largest life insurance market in the world and the fifth-largest in Asia, as per Swiss Re’s sigma No 3/2021 report for July 2021. The size of the Indian life insurance industry was Rs. 6.2 trillion based on total premium in Fiscal 2021, up from Rs. 5.7 trillion in Fiscal 2020. The industry’s total premium has grown at 11% CAGR in the last 5 years ending in Fiscal 2021. New business premiums (NBP) grew at 15% CAGR during Fiscals 2016 to 2021, to approximately Rs. 2.78 trillion. Below are the factors responsible for such growth:

- Population increase – India’s population growth is showing an upward trend. Thus, more people means more insurers who will become loyal customers and will bring in more revenue in the long run.

- Urbanization – Educated people living in urban areas will prefer life insurance because of unpredictable lives. People will prefer insurance products as a source of security for their families and children.

- Company insurance – All the companies are trying to tie up with insurance companies to provide work-life balance and help retain employees. Corporate insurance has now become a part of employee benefit programs.

- Post covid fear– Post covid people want to get themselves insured as the pandemic still exists. Waves of covid are never-ending.

- Digitalization of the insurance industry – People have drifted towards online services. Thus Insurance industry in India has started digitalization, like setting up Sales app, LIC Quick Quotes App, Portal & Mobile App for Chief Life Insurance Advisors, PRAGATI App, Online Micro Insurance, merchant portal, Online Pre-recruitment Training, etc.

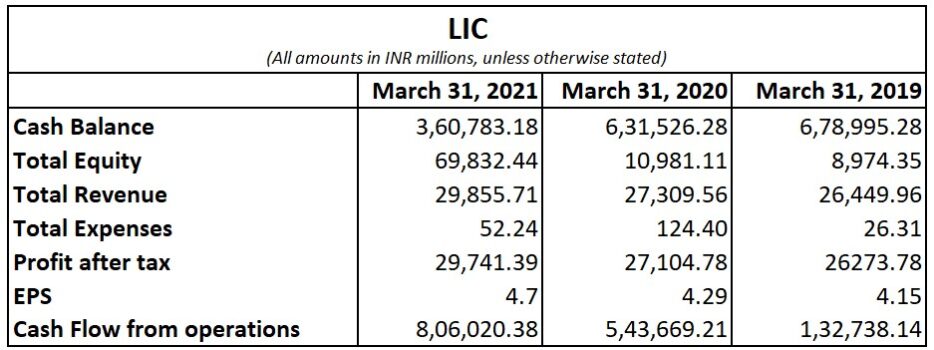

Financial Highlights & trends (2021-2019)

- Cash Balance – Total cash balance reduced by 47% in 2021

- Total Equity also increased by 678% in 2021

- Total Revenue increased by 13%

- Total Expenses increased by 99%

- Profit after tax increased by 1586%

- Cash Flow from operations increased by 507%

Below are inferences –

- Cash balance has reduced, thus may have a liquidity crunch

- Equity has increased significantly in these 3 years

- Total revenue has been increased consistently year on year

- Profit after tax has multiplied

- Cash flow from operations has also increased significantly

LIC IPO – Subscribe or Not?

Limited money investors – Apply

Risky investors with enough money – Subscribe for the short to medium term.

Any risks?

The forecasted growth looks promising but considering the recent deteriorating market share, and offer for sale as a major objective, you may know the risks associated with it:

- Deteriorating market share, and aggressive private players

- Offer for sale as the primary purpose

Strengths of LIC IPO

- Growing income and online literacy level of people in India, demand for insurance will increase.

- Covid making Insurance attractive

- Seen as a wealth creation tool

- Huge AUM and brand loyalty where people are invested for longer terms

- Tenure and matured company

- Rs 45/- discount to retail category and Rs 60 discount to policyholders matters

- LIC IPO GMP today is Rs 90/- per share

Challenges of LIC IPO

- Higher operational costs due to agent’s commissions thus the company is left with squeezed profit margins.

- Comply with various national and local laws and regulations.

- Competitive pricing from private insurers

The strengths listed overweighs the challenges called out. Thus, we recommend a LIC IPO subscription.

Short term or Long-Term Hold

If you still want to buy LIC IPO shares then go for the short to medium term.

We recommend you to enroll in our Stock broker trading course which will help you to pick the rewarding IPO and earn huge profits.

What is your opinion about LIC IPO?

Disclaimer – Investing in the stock market is subject to market risk, thus kindly consult your financial advisor before investing or consult our financial advisor 😊