Want your money to multiply at a faster rate? Money minting is an art, while mutual funds are the tools to facilitate this art. You surely can become a millionaire, it requires investing in the right choice of mutual funds, at the right time, while staying invested for a longer period of time. Even before investing in any mutual funds, it’s better to check the expected return through a mutual fund return calculator. The mutual fund return calculator gives you a fair idea of the corpus generated at the end of a specified number of years, assuming a minimum rate of interest.

Table of Contents

What are mutual funds?

You as an investor want to invest in the stock market but you lack professional expertise. Besides, it is a risky decision that may swing on either side resulting in huge profits or huge losses. Rather than taking the risk on your head, you transfer this risk to mutual funds that have professional experts to manage your investment to maximize return while mitigating risks at all levels. Mutual funds provide an investment platform to investors who want to ride the stock market wave but with risk mitigation. In return, the investors need to pay a service charge in the form of an expense ratio to the mutual fund agencies for managing their funds effectively. Mutual fund companies usually pool the funds from all the investors and invest them in various financial instruments to maximize returns. The kind of securities they invest the money in determines the type of mutual fund. The mutual funds do this by The mutual fund will start managing your funds from the day your funds have been invested in their mutual fund scheme. Entry and exit timing still remain with you which is the deal-breaker here. Historical returns should be checked by any investor before investing their hard-earned money into any mutual fund scheme. This has become easier through the mutual fund’s calculator which provides forecasted returns to you when you mention your investment amount, holding time frame, and the minimum rate of return. There are various mutual fund schemes to suit the various needs of the investors.

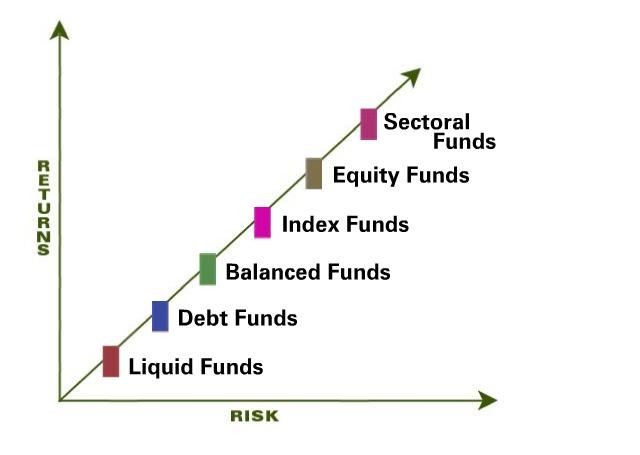

Types of mutual funds

There are various types of mutual funds to meet the needs and requirements of different investors as below:

Equity funds

These funds are invested in equity shares. These funds may invest money in growth stocks, momentum stocks, value stocks, or income stocks depending on the investment objective of the fund.

Debt funds or Income funds

These funds are invested in bonds and money market instruments. These funds may invest in long-term and/or short-term maturity bonds.

Hybrid funds

These funds are invested in a mix of both equity and debt. In order to retain their equity status for tax purposes, they generally invest at least 65% of their assets in equities and roughly 35% in debt instruments, failing which they will be classified as debt-oriented schemes and be taxed accordingly. Monthly Income. Plans (MIPs) fall within the category of hybrid funds. MIPs invest up to 25% into equities and the balance into debt.

Sectoral Funds

These funds are expected to invest predominantly in a specific sector. For instance, a banking fund will invest only in banking stocks. Generally, such funds invest 65% of their total assets in a respective sector.

Index Funds

These funds seek to have a position that replicates the index, say BSE Sensex or NSE Nifty. They maintain an investment portfolio that replicates the composition of the chosen index, thus following a passive style of investing.

Fund of Funds (FOF)

Your money is invested in other funds of the same mutual fund house or other mutual fund houses. They are not allowed to invest in any other FOF and they are not entitled to invest their assets other than in mutual fund schemes/funds, except to such an extent where the fund requires liquidity to meet its redemption requirements, as disclosed in the offer document of the FOF scheme.

How to choose a mutual fund?

Selecting the right fund to invest in determines the future returns. Best mutual fund investment will determine your future wealth. Below are the points that should be taken care of before investing in any mutual fund scheme:

- Historical data – Check the history of the fund, its age, current NAV value, and other aspects before taking the final call. The historical return should be reviewed carefully, whether the annual or absolute returns were positive, or whether they reflected an upward or downward trend. Year on year growth indicates a financially healthy mutual fund. Huge fluctuations might not be too attractive for any investor. A fund performing better than Sensex or NIFTY surely wins the investor’s heart.

- Expense ratio – It is the percentage charged by the mutual fund company to the investors for managing their funds on their behalf. This is more like a fee charged by them to manage the investor’s funds while mitigating risk and maximizing returns. The lower is the expense ratio, the more will be the take-home returns for the investors. The higher is the expense ratio, the lower will be the take-home returns for the investor. The investor should choose a fund with a lower expense ratio so as to maximize his take-home returns.

- Exit load – There is an entry or exit load or a fixed percentage charged to the investor while he enters the scheme or exists the scheme based on specified terms and conditions. Mutual fund schemes usually have these loads to prevent the investor from exiting the scheme early. Mutual fund companies usually pool the funds from all the investors and invest them in various financial instruments to maximize returns. If the investor exits early from the scheme, the fund so invested by the investor is already invested by the mutual fund in securities for a specified tenure. Early withdrawal with trigger penalty for the mutual fund company, which is in turn recovered from the investor in the form of exit load. An investor should either invest spare funds for a long tenure. If uncertain then should choose a mutual fund with no or very less exit load.

- Credit rating – Mutual fund schemes are rated by Credit rating agencies of India like CRISIL, ICRA. They consider various risk factors, competition, financial figures, and futuristic plans to rate a particular mutual fund. Their rating ranges from 1 star to 5 stars. 5 star rated mutual funds gain more attention from investors. An investor should choose a good-rated mutual fund with moderate risk factors.

- Mutual fund company’s financials – The company with a mutual fund scheme should have strong financials and background, to absorb any shocks or uncertainties. Thus, checking the creditworthiness of mutual fund companies is important so as to decide whether to invest your money into the scheme or not.

- Mutual fund return calculator – Checking what will be a lump sum calculator for mutual funds or a sip calculator for mutual funds is necessary to make the final decision. Lump-sum or sip calculation, the mutual fund return calculator will give you a forecasted amount considering the rate of return, time period and amount of lump sum or sip punched into the mutual fund return calculator.

What is a Mutual fund return calculator?

A mutual fund return calculator is a tool that tells you what amount of wealth you will generate if you invest a particular amount in a lump sum or in a SIP (systematic investment plan) in a mutual fund scheme. A mutual fund scheme with historical data will let you know the CAGR or rate of return in 1, 2, 5, 10, 15, 20 years respectively both in the case of a lump sum as well as in the case of SIP.

You need to input the below information to get the forecasted return in the mutual fund return calculator:

For Lump sum amount:

- Input the lump sum amount

- Number of years that you will keep holding the investment

- Rate of return – this information you may get from the historical mutual fund return data from any website like moneycontrol.

For SIP (Systematic Investment Plan) amount

- Input the SIP sum amount

- Number of years that you will keep holding the investment

- Rate of return – this information you may get from the historical mutual fund return data from any website.

The forecasted amount at the end of the time period specified will depend upon the below factors:

- The entry time in any mutual fund scheme will depend upon the investor, mutual fund return calculator will not tell the exact entry time.

- The exit time in any mutual fund scheme will depend upon the investor again. The mutual fund return calculator will again not predict the exact exit time.

- The rate of return will be dependent upon the mutual fund scheme and its performance.

- The time period will again want to remain dependent upon the investor as to how long it wants to remain invested.

- The future is unpredictable and inflation is usually not taken into account.

FunFact:

- Minister of finance India, stated that as of 31 October 2021, over 135,000 investors earning between Rs 1 crore to Rs 5 crore yearly had invested Rs 9.93 lakh crore in MFs. This comprises 30.91% of the total money invested by investors in MFs.

- The top 2 Mutual funds to invest in India in 2022 are:

Mirae Asset Emerging Bluechip fund - As of today, you may invest only Rs 2500/- per month only in the form of an SIP amount. This fund has restricted investment in lump sum amount or

investing amount greater than Rs 2500/- even in the form of SIP.

Quant Active Fund- Direct Plan Growth fund- Invest when the market is bearish, you may decide to invest in the form of SIP or through lump sum amount as both are acceptable.

Does mutual fund return calculator considers inflation?

Many mutual fund return calculators do not explicitly consider inflation when forecasting returns. Instead, they often provide nominal returns, which represent the investment’s return before adjusting for inflation. These calculators assume that the user is interested in understanding how the investment’s value will grow without accounting for the effects of rising prices. Here’s why mutual fund return calculators typically don’t incorporate inflation and why they focus on nominal returns:

- User Intent: The primary purpose of most mutual fund return calculators is to provide investors with a straightforward estimate of how their investment can grow over time in nominal terms. This information helps investors understand how their wealth or investment value may increase without accounting for external factors like inflation.

- Simplicity: Incorporating inflation into return calculations can make the results more complex and potentially confusing for users, especially those who may not have a deep understanding of financial concepts. Providing nominal returns keeps the calculations simpler and more accessible.

- Inflation Is Variable: Inflation rates can vary significantly over time and across regions. Calculators that incorporate inflation would need to make assumptions about future inflation rates, which can be highly uncertain and speculative.

Example: Suppose you invest $10,000 in a mutual fund that has an average annual nominal return of 8%. After 10 years, without considering inflation, your investment would grow to:

$10,000 * (1 + 0.08)^10 = $21,589.40

This calculation provides the nominal value of your investment after 10 years.

Now, let’s consider the impact of inflation. If the average annual inflation rate over those 10 years was 3%, your purchasing power would decrease over time. To calculate the real return (adjusted for inflation), you would need to deduct the inflation rate from the nominal return:

Real Return = (1 + Nominal Return) / (1 + Inflation Rate) – 1

Real Return = (1 + 0.08) / (1 + 0.03) – 1 = 0.0485 or 4.85%

So, after adjusting for inflation, your real return is approximately 4.85% per year.

Some financial calculators or investment planning tools may allow you to input an assumed inflation rate to estimate real returns, but many simpler mutual fund return calculators do not include this feature. To get a more accurate understanding of how inflation will affect your investment, you may need to perform additional calculations separately or use specialized financial planning tools that consider both nominal and real returns.

How inflation affects mutual fund returns?

inflation can have a significant impact on mutual fund returns, and its effects should be understood by investors. Inflation is the rate at which the general level of prices for goods and services rises, resulting in a decrease in the purchasing power of a currency. Here’s how inflation affects mutual fund returns in detail:

- Purchasing Power Erosion: Inflation erodes the purchasing power of money over time. If the rate of return on a mutual fund does not keep pace with inflation, the real (inflation-adjusted) returns for investors can be negative. For example, if a mutual fund generates a 5% return in a year, but inflation is 3%, the real return is only 2%, meaning your money has effectively lost purchasing power.

- Impact on Fixed-Income Investments: Mutual funds can invest in various asset classes, including stocks, bonds, and cash equivalents. Inflation has a more direct impact on fixed-income investments like bonds. When inflation rises, the fixed interest payments from bonds become less valuable in real terms. If interest rates don’t keep up with inflation, the purchasing power of bond income decreases.

- Equity Investments: Inflation can also affect mutual funds that invest in equities (stocks). While stocks have historically provided a hedge against inflation over the long term, short-term fluctuations in inflation can influence investor sentiment and market dynamics. Rapidly rising inflation can lead to uncertainty and market volatility.

- Sector and Industry Impact: Different sectors and industries can be impacted differently by inflation. Some sectors, like consumer staples and utilities, may be less sensitive to inflation, while others, like commodities, may benefit from rising prices. Mutual funds with varying sector exposures can be affected differently by inflation.

- Central Bank Policies: Central banks often adjust interest rates and monetary policy to manage inflation. Changes in interest rates can affect the performance of mutual funds, particularly those holding bonds. Rising interest rates can lead to lower bond prices, potentially impacting the NAV (Net Asset Value) of bond-focused mutual funds.

- Asset Allocation and Diversification: Asset allocation and diversification are important strategies for managing the impact of inflation on mutual fund portfolios. Diversifying across different asset classes can help mitigate the negative effects of inflation on overall portfolio returns.

- Real Assets and Inflation Hedges: Some mutual funds invest in real assets like real estate and commodities, which can serve as hedges against inflation. Real assets often have intrinsic value that can appreciate with inflation, potentially helping to preserve purchasing power.

- Time Horizon: The impact of inflation on mutual fund returns may be more pronounced over longer time horizons. Investors with longer investment horizons may need to consider strategies for addressing inflation risk, such as investing in assets with a history of inflation protection.

In summary, inflation can erode the real returns of mutual funds, particularly fixed-income investments, and it can introduce volatility and uncertainty into financial markets. Investors should carefully consider the potential effects of inflation when constructing their investment portfolios and may seek professional advice to develop strategies for managing inflation risk.

In summary, mutual fund return calculators serve as valuable tools for gaining a general understanding of how investments may grow over time. However, investors should recognize their limitations, particularly the lack of consideration for inflation, and use these calculators as part of a broader financial planning and investment strategy. Additionally, it’s essential to remain vigilant about changing market conditions and periodically reassess investment goals and strategies.