Should you subscribe or avoid Vedant Fashions IPO? Vedant Fashions you may popularly call as Manyavar IPO. It will be out on Feb 4, 2022, and closes on Feb 8, 2022. Below are some of the important dates and details:

| IPO Details | Dates |

| IPO open date | Feb 4, 2022 |

| IPO close date | Feb 8, 2022 |

| Price band | Rs 824 – Rs 866 |

| Minimum lot quantity | 17 |

| Allotment date | Feb 11, 2022 |

| IPO listing date | Feb 16, 2022 |

Table of Contents

Purpose of usage of Vedant Fashions or Manyavar IPO funds:

Below are the ways how the company intends to use the proceeds from IPO.

- Offer for Sale – The existing shareholders will receive the proceeds from selling their shares to the public.

Background & Business – Vedant Fashions:

They are the ones who help the bride and the groom to get the most gorgeous look for their wedding day. Premier clothing brand dealing in both men’s and women’s wear known for their exclusive collections.

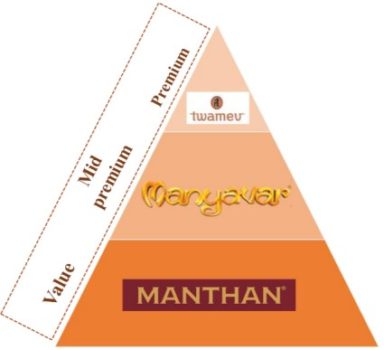

The business has 4 brands as mentioned below:

- Manyavar – Men’s wear comes under the mid-price range

- Mohey – Women’s wear again a mid-price range

- Mebaz – Men’s women’s and kid’s brands in South India with mid-price range

- Manthan – Men’s brand low-cost range

- Twameu – men’s premium brand under premium price range

Manyavar is their leading brand which contributes above 80% of their total revenue throughout the years. This brand uses below mentioned sales channels:

- Exclusive brand outlets (EBO)

- Multibrand outlets (MBO)

- Large-format stores (LFS)

- E-commerce

Of the above, EBO contributes above 90% of the company’s revenue.

COVID Impact on Business:

Covid-19 impacted Vedant Fashions business operations especially when lockdown became operational during the first wave. Since 90% of their sales came from Exclusive brand outlets (EBO) which were temporarily closed due to lockdowns impacted sales to a great extent. The expansion plans were kept on hold for the conditions to improve. Below are the reasons that in the future such a pandemic would impact the business:

- Consumer spending power decreased thus lifestyle products were less consumed.

- Due to lockdown, people had no intention of purchasing more clothes.

- Covid restrictions on the total number of people who could attend any marriage or any occasion impacted sales.

- The drastic shift in the wedding culture of India from a fat wedding to a closed wedding has started making rounds, with less expenditure on lifestyle products.

The above-mentioned reasons will impact the company’s sales however yet to see after covid how the wedding industry in India revolves and that would be the deciding factor.

Government incentives:

- Promoting Girl child education- the kid’s wear market is huge. With Government supporting, promoting, and encouraging girl child education will spike the demand for girl’s wear.

Forecasted Growth:

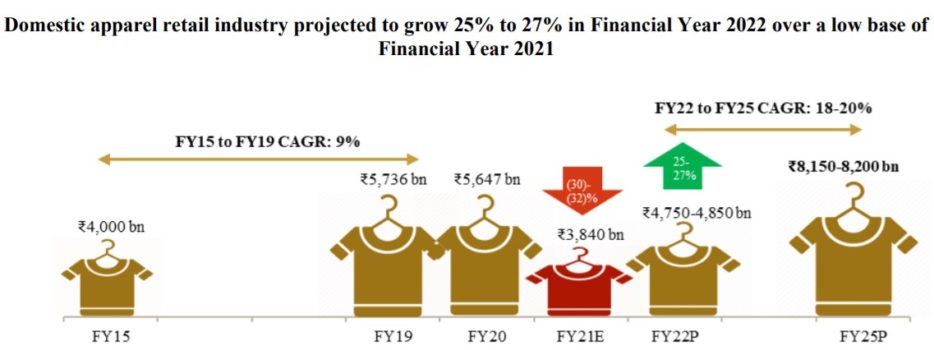

The Indian apparel retail market is expected to grow from FY22 to FY25 at a CAGR of 18% to 20%. The domestic market is expected to continue to grow strongly until Financial Year 2025, clocking up to ₹8.1 trillion to ₹8.2 trillion, registering a CAGR of about 18% to 20% between FY 2022 and 2025.

Below are the factors responsible for such growth:

- Population increase – India’s population growth is showing an upward trend. Thus more people will become loyal customers bringing in more revenue in the long run.

- Urbanization – Educated people living in urban areas will prefer more lifestyle products. The clothing brand will be on the top list. With many remote areas being developed, this brand has a scope.

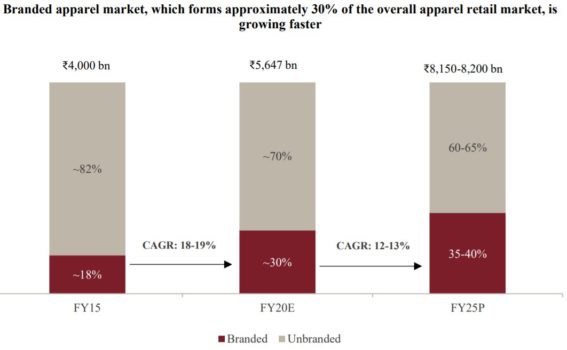

- Fashion Trends – Inspired by actors, influencers, and movies, fashion is trending. Designer clothes, stylish clothes are being preferred over local ones. Branded products are the hot sellers.

- Working women population on increase -Women are bringing in money by working. With the rise in the working women population, the demand for women’s clothes is on rising.

- Online purchase – People have drifted towards online buying. There is nothing more amazing than getting things delivered to your doorstep at a click. This leaves a lot of scope for this company.

The branded apparel market is expected to grow from 30% in FY20 to 35% to 40% in FY25.

Financial Highlights & trends (2021-2019)

- Cash Balance – Total cash balance reduced by 94% in 2021

- Total Equity also increased by 24% in 2021

- Total Revenue decreased by 24%

- Total Expenses decreased by 19%

- Profit after tax decreased by 25%

- Cash Flow from operations increased by 8%

Below are inferences –

- Cash balance has reduced, thus may have a liquidity crunch

- Equity has increased in these 3 years

- Total revenue has been decreased year on year

- Profit after tax has been reduced year on year

- Cash flow from operations is slightly improved.

Vedant Fashions IPO – Subscribe or Not?

Limited money investors – Go for listing gains if the market is bullish else Avoid it.

Risky investors with enough money – Subscribe for the long term.

Why should limited money investors avoid it?

The forecasted growth looks promising but considering recent deteriorating profits, and offer for sale as a major objective, you may avoid this IPO.

- Deteriorating profits & EPS year on year with declining revenue

- Vedant fashions IPO valuation – overvalued

- Offer for sale as the primary purpose

- GMP, around 10% IPO Grey market

However, if you want to take a risk then go for this IPO.

Strengths of Vedant fashions IPO

- Growing income and online literacy level of people in India, demand for fashionable clothes will increase.

- Increased usage of Online portals to purchase branded clothes.

- Expanding market outside India.

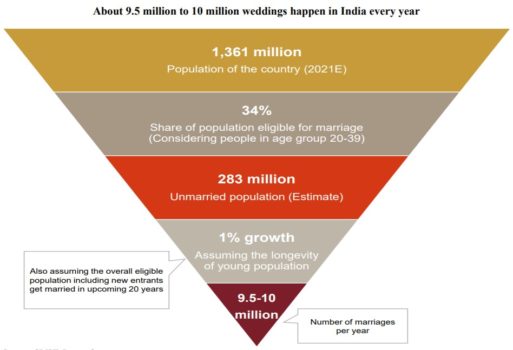

- The Indian wedding market and celebration market is very big.

Challenges of Vedant fashions IPO

- Higher operational and finance costs for EBO’s thus the company will be left with squeezed profit margins.

- High competition from established competitors.

- Comply with various national and local laws and regulations.

- Competitive pricing.

- Wedding days have narrowed to the 1-day event, with lesser people, so there is a drastic cultural shift seen.

The challenges listed overweighs the strengths called out. Thus, we recommend Vedant fashions IPO only for listing gains provided the market is bullish else avoid it.

Short term or Long-Term Hold

If you still want to buy Vedant fashions IPO shares then go for the long term. Holding these for the short term might not give you desired appreciated value.

We recommend you enroll in our Stock broker trading course which will help you to pick the rewarding IPO and earn huge profits.

What is your opinion about Vedant fashions IPO?

Disclaimer – Investing in the stock market is subject to market risk, thus kindly consult your financial advisor before investing or consult our financial advisor 😊