Your purchasing power is dependent upon your cash balance. Some may argue that with credit cards, buy now pay later facility, you don’t really have to bother about actual cash balance, but the truth is there is a high cost attached to borrowed money. If you use money that does not belong to you, you end up paying the high-interest costs. The same applies to businesses, whose cash requirement is much higher, if not fulfilled may affect the operations. Thus, cash management models help business to manage their cash requirements with ease.

Table of Contents

What are Cash management Models?

There are 2 well-known cash management models Baumol model of cash management and Miller orr model of cash management. Both of them aim towards maintaining optimum cash balance and healthy working capital. Working capital management is important for any business as the business needs to meet its current obligations without delay, if not met, defaulting on current obligations will deteriorate its creditworthiness. Cash crunch for a business is more like a dead end, with no alternative way out. It exposes businesses to severe volatility with no cushion to absorb any shocks. Thus above 2 models help the business to determine the optimum cash balance to run their operations with ease.

What is Baumol Model of cash management?

William J. Baumol created the Baumol model. This model takes inventory management as a base to formulate optimum cash balance for the business. As per this model, an attempt is made to minimize the cost of holding cash and the cost of converting marketable securities into cash. Below are the assumptions made:

- The forecast of cash needs is certain.

- Cash payments occur uniformly.

- The opportunity cost of holding cash is known and is constant.

- Transaction cost is the same throughout the year.

- The firm procures cash by selling marketable securities (products or services), and then it uses the cash till it exhausts completely.

- Cash is again relished by selling securities, just in time when it is about to get completely exhausted or reach zero balance.

Example of Baumol Model

Let us assume that the firm starts with a Cash balance of Rs 1000. As the firm utilizes its cash, the cash balance decreases and becomes zero. It is when the firm replenishes its cash again. Hence the average cash balance will be = Rs 1000/2 = Rs 5000.

Hence the formula of Average Cash Balance is (C – 0) / 2 = C/2.

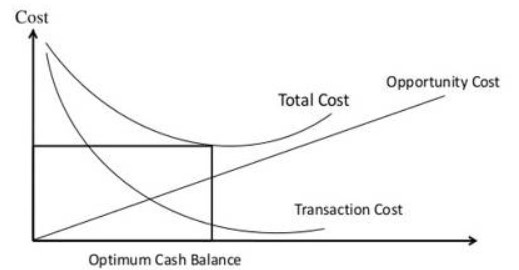

The firm incurs the holding cost of cash which is also called opportunity cost. If the cash would have been invested elsewhere, it would have earned a return, that return is forgone when cash remains idle with the firm. If “K” is the opportunity cost then Holding Cost = K (C/2).

The firm also incurs transaction costs whenever it sells its marketable securities for cash. Let the cost per transaction be (L). The total number of transactions during the year would be the Total fund requirement divided by individual installments of fund procurement i,e T/C. hence Total transaction cost = L ( T/C).

Baumol Model Formula

To find optimum cash balance below formula was developed using the Baumol model of cash management replicating the EOQ (Economic Order Quantity) formula for inventory management:

Holding Cost = K (C/2)

Transaction Cost = L (T/C)

Total Cost = L (T/C) + K (C/2)

Optimum Cash Balance = √ 2 LT / K (Square root of 2 LT/K) where

- L = Transaction cost (per transaction)

- T = Total annual requirement of funds

- K = Opportunity cost of holding cash

What are the limitations of the Baumol model?

The Baumol model suffers from a major limitation based on its assumptions. It assumes that cash flows in a firm can be predicted accurately and the outflow also remains fixed and certain. In practice, the cash inflows and outflows of a firm are highly unpredictable. There are huge fluctuations owning to both internal and external factors. Thus, applying Baumol’s model of cash management may be unrealistic.

What is Miller – ORR Model of cash management?

The Miller ORR Model overcomes the limitations of the Baumol model of cash management. M.H. Miller and Daniel Orr tool Baumol model as a base, worked upon its modifications assuming firm has uncertain cash inflows and outflows.

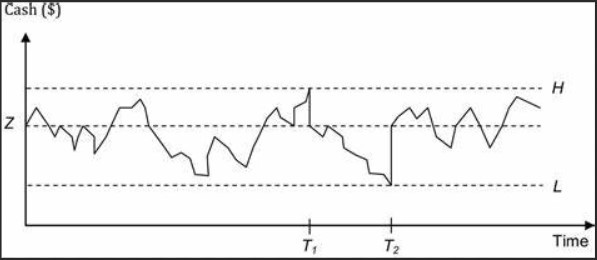

It reflects upon the cash fluctuations. It provides for 2 control points, the upper control limit, and the lower control limit. It also provides for a return point. When the cash balance hits the upper limit, then the company buys marketable securities and spends cash so as to come back to the return point. Similarly, when the company’s cash balance hits the lower limit, it sells some of its marketable securities to procure cash so as to bounce back to the return point. The company sets its lower control limit based on its own minimum cash balance requirement.

Miller – Orr Model Formula

The distance of the upper limit from the lower limit can be found out by the following factors:

- Transaction cost

- Interest rate

- The standard deviation of the net cash flows

Upper limit – Lower limit = Z = (¾ x Transaction cost x cash flow variance / Interest per day)1/3

Upper Limit = Lower limit + 3Z

Return point = Lower limit + Z

Average cash balance = Lower limit + 4/3 Z

Above is the optimum cash balance formula to be used to know the cash requirement. Miller’s model is one of the best cash management models which is used practically because it has overcome Baumol’s model’s limitations.

Benefits of Cash management models:

- Working capital management

These cash models help a firm to maintain an optimum level of working capital. Positive working capital helps a firm to continue its daily operations smoothly. It does not have to worry about meeting current obligations.

- Preventive measures

Cash flow models focus on taking preventive actions in case of a liquidity crunch. It prevents any sort of cash crunch or triggers a red flag whenever the cash position declines. Optimum cash balance is maintained at all levels.

- Prepares for unforeseen situations

Cash management models do help in preparing a company to absorb any shocks during unforeseen circumstances. Seasonal fluctuations, inflations, changes in pricing strategy, etc. can be easily tackled. It helps in withstanding and surviving through difficult times.

- Liquidity

With the optimum level of cash balance, the company may take advantage of an opportunity that provides good returns. With changing times, cornering financial opportunities to earn returns makes the most sense.

- Cost control

The cost of financing working capital requirements is very expensive. Thus, cash management models, help the firms to avoid this cost by keeping the cash balance in check. It leads to cost control in the long run.

Motives for holding Cash?

Why would the company prefer holding cash? The answer is summed up in the below points:

- Transaction motive – To meet day-to-day expenses, such as paying creditors, buying raw materials, paying staff, paying operational costs.

- Precautionary motive – To meet unpredictable or emergency situations like natural calamities, pandemic like covid-19.

- Speculative motive – To take advantage of profit-making opportunities, e.g. – investment with good returns, bulk purchase with a discount.

What is cash management service?

Cash management services, often provided by banks and financial institutions, are designed to help businesses and individuals efficiently manage their cash flow, maximize the use of available funds, and optimize their financial operations. These services offer various tools and strategies to ensure that funds are readily available when needed while potentially earning a return on idle cash. Here are some examples of cash management services in detail:

- Checking and Savings Accounts:

- Business Checking Accounts: These accounts are designed for business use and often offer features like unlimited transactions, online banking, and mobile banking for easy access to funds.

- Savings Accounts: Individuals and businesses can use savings accounts to earn interest on surplus cash while maintaining liquidity.

- Sweep Accounts:

- A sweep account is an automated service that transfers excess cash from a checking account into a higher-interest investment, such as a money market fund, at the end of each business day. This helps maximize returns on idle cash while ensuring liquidity for daily operations.

- Lockbox Services:

- Businesses that receive a high volume of payments in the form of checks can use lockbox services. These services involve the outsourcing of payment processing to a bank, where payments are collected, processed, and deposited on behalf of the business.

- Zero Balance Accounts (ZBA):

- ZBA accounts are used by businesses to maintain a target balance in their primary operating account. Funds are automatically transferred to or from a concentration account to achieve this target, which reduces the risk of idle cash and overdrafts.

- Merchant Services:

- Merchant services encompass various payment processing solutions, including credit card processing, e-commerce payment gateways, and point-of-sale systems. These services help businesses efficiently handle customer payments, improving cash flow.

- Remote Deposit Capture:

- This service enables businesses to deposit checks electronically from their own location using a check scanner or a mobile device. It accelerates the availability of funds and reduces the need to visit a physical bank branch.

- Cash Forecasting:

- Cash forecasting services provide tools and analysis to help businesses predict their future cash flows accurately. This enables proactive decision-making and better management of working capital.

- Online Banking and Cash Management Tools:

- Many banks offer online platforms with features like real-time account access, funds transfers, bill payments, and customizable reporting. Businesses can use these tools to monitor and manage their cash position effectively.

- Sweeps and Concentration Services:

- Sweeping involves moving funds from multiple accounts into a central account for better control and management. Concentration services allow businesses to consolidate funds from various locations or accounts to optimize their use.

- Fraud Prevention Services:

- These services include Positive Pay and ACH (Automated Clearing House) filters to protect against fraudulent transactions by cross-referencing checks and electronic payments against authorized lists.

- Foreign Exchange Services:

- For businesses involved in international trade, foreign exchange services help manage currency exchange risk, facilitate international payments, and offer competitive rates.

- Credit Lines and Overdraft Protection:

- Businesses may have access to revolving credit lines or overdraft protection to cover temporary cash shortages, ensuring that payments are not missed.

Effective cash management is essential for both individuals and businesses to maintain financial stability, seize investment opportunities, and minimize costs. The choice of specific cash management services will depend on financial goals, operational needs, and risk tolerance. Businesses should consult with their banks or financial advisors to determine the most appropriate cash management strategies and services for their circumstances.

FunFact:

- Oracle NetSuite has launched Cash 360 to manage cash in real-time.

Which cash management models do you prefer?