If you are a businessman and are looking for a commercial loan,? Then you are in the right place as this outstanding Commercial loan Truerate Services answers your problems. Gone are the days when you need to search for funders or lenders, compare commercial loan interest rates, negotiate terms and conditions, and employ lawyers to abide by legal rules. This new Commercial loan Truerate Services will not only help you to get easy loans but also at the lowest interest rates to cut down on your total cost.

Table of Contents

What is Commercial loan Truerate Services?

TrueRate is a commercial loan pricing and analysis platform that provides users with real-time, accurate loan pricing and analytics. The platform allows users to price and compare commercial loans from multiple lenders, as well as analyze the profitability of loans and portfolios. It can be used by commercial lenders, brokers, and borrowers to negotiate better loan terms and make informed lending and borrowing decisions. TrueRate offers a range of pricing and analysis tools, including a loan pricing engine, a deal comparator, and a portfolio analytics tool. It also provides users with access to market data and analytics, as well as educational resources to help them understand commercial lending and borrowing.

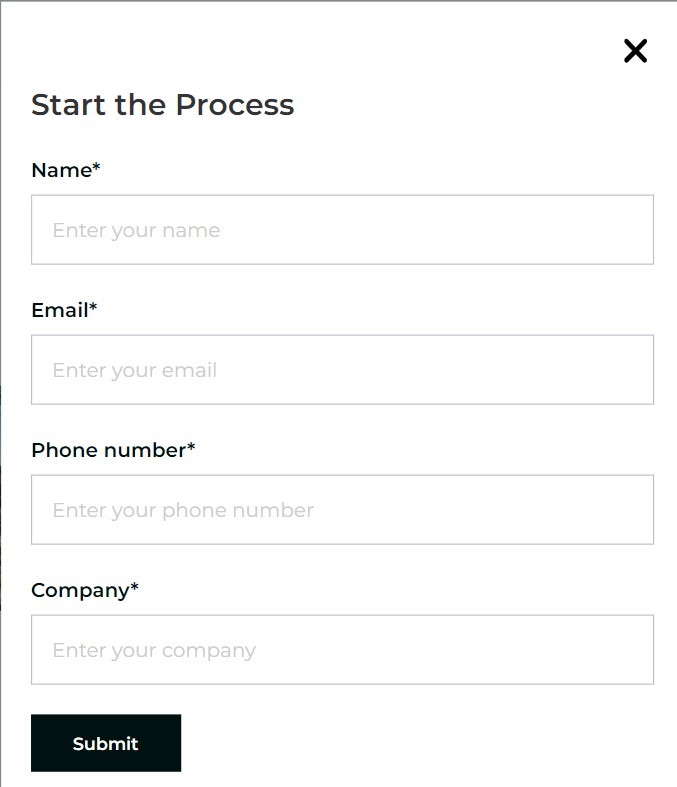

To get instant financing click on ‘Get Financing”, fill details in the popup template, and submit to get an instant response

Types of services provided by Commercial loan Truerate Services?

TrueRate offers a range of commercial loan pricing and analysis services, including:

- Loan pricing engine: This tool allows users to price and compare commercial loans from multiple lenders in real time. It includes features such as adjustable loan terms, fees, and rates, as well as the ability to compare loan offers side-by-side.

- Deal comparator: This tool allows users to compare and analyze the profitability of different loan deals and scenarios. It includes features such as the ability to adjust loan terms, fees, and rates, as well as the ability to compare deals side-by-side.

- Portfolio analytics: This tool allows users to analyze and optimize the performance of their commercial loan portfolios. It includes features such as portfolio stress testing, risk analysis, and performance reporting.

- Market data and analytics: TrueRate provides users with access to real-time market data and analytics, including interest rates, spreads, and other key market indicators.

- Educational resources: TrueRate offers a range of educational resources to help users understand commercial lending and borrowing, including guides, webinars, and other educational materials.

The traditional way of getting Commercial loans

There are several ways you can potentially save money on a commercial loan:

- Shop around: One of the most effective ways to save on a commercial loan is to shop around and compare rates and terms from multiple lenders. By doing this, you may be able to find a lender that is willing to offer more favorable terms than others.

- Negotiate: Once you have found a lender that you are interested in working with, try negotiating for better loan terms. This may involve asking for a lower interest rate, lower fees, or more favorable repayment terms.

- Improve your credit score: A higher credit score may help you qualify for more favorable loan terms, including lower interest rates. To improve your credit score, consider paying your bills on time, reducing your credit card balances, and disputing any errors on your credit report.

- Choose a shorter loan term: In general, shorter loan terms may be associated with lower interest rates. By choosing a shorter loan term, you may be able to save money on interest over the life of the loan.

- Make a larger down payment: A larger down payment can help reduce the amount of the loan and may also result in lower interest rates.

- Consider a fixed-rate loan: Fixed-rate loans have interest rates that remain the same throughout the loan term, which can provide stability and predictability. By contrast, adjustable-rate loans have interest rates that can change over time, which can make them riskier and potentially more expensive.

Advantages or benefits of using Commercial loan Truerate services

There are several potential benefits of using TrueRate’s commercial loan pricing and analysis services:

- Real-time pricing: TrueRate’s loan pricing engine provides users with real-time, accurate loan pricing information, which can help them make more informed lending and borrowing decisions.

- Comparison tool: TrueRate’s deal comparator tool allows users to compare and analyze different loan deals and scenarios, which can help them find the most profitable options.

- Portfolio analytics: TrueRate’s portfolio analytics tool allows users to analyze and optimize the performance of their commercial loan portfolios, which can help them manage risk and maximize returns.

- Market data and analytics: TrueRate provides users with access to real-time market data and analytics, which can help them stay informed about trends and developments in the commercial lending market.

- Educational resources: TrueRate offers a range of educational resources to help users understand commercial lending and borrowing, which can be valuable for those who are new to the industry or who want to deepen their knowledge.

Overall, TrueRate’s commercial loan pricing and analysis services can help lenders, brokers, and borrowers make more informed and profitable decisions when it comes to commercial lending and borrowing.

Limitations of Commercial Loan Truerate Services

TrueRate’s tools and resources may have certain limitations or may not be suitable for all users or situations. For example, TrueRate’s tools may not be able to take into account every possible factor that could affect the pricing or profitability of a commercial loan, such as the borrower’s specific financial circumstances or the unique characteristics of the property being financed. In addition, TrueRate’s tools and resources may not be able to provide an exhaustive list of every commercial lender or loan product available in the market, and users may need to consider other sources of information and options in order to make fully informed decisions. It’s always a good idea to carefully consider the suitability of any financial product or service for your specific needs and circumstances before making a decision.

How to calculate a commercial mortgage payment?

To calculate the monthly payment on a commercial mortgage, you will need to know the following information:

- The loan amount: This is the total amount of money being borrowed.

- The interest rate: This is the percentage of the loan amount that will be charged as interest.

- The loan term: This is the length of time over which the loan will be repaid, typically in years.

- The amortization period: This is the length of time over which the loan will be fully paid off, including both principal and interest.

To calculate the monthly payment, you can use the following formula:

Monthly payment = (Loan amount * Interest rate) / (1 – (1 + Interest rate) ^ (-Loan term * 12))

For example, if you are borrowing $1,000,000 at a 5% interest rate for a 10-year loan with a 20-year amortization period, your monthly payment would be approximately $5,477.

Note: This is a simplified version of the mortgage payment formula, and it does not take into account additional factors such as fees and escrow payments.

Factors affecting Commercial Loan Pricing

There are many factors that can affect the pricing of a commercial loan, including the borrower’s creditworthiness, the type of property being financed, the loan term, the loan-to-value (LTV) ratio, and the lender’s risk tolerance and underwriting criteria.

Here are a few examples of how these factors can impact the pricing of a commercial loan:

- Creditworthiness: Borrowers with strong credit histories and financial profiles may be able to secure more favorable loan terms, such as lower interest rates and fees, compared to borrowers with weaker credit or financial profiles.

- Property type: The type of property being financed can also impact loan pricing. For example, a lender may charge a higher interest rate for a risky or hard-to-finance property, such as a vacant lot or a property in a declining market.

- Loan term: The length of the loan term can also affect the pricing of a commercial loan. In general, shorter loan terms may be associated with lower interest rates, while longer loan terms may come with higher rates.

- LTV ratio: The LTV ratio is the ratio of the loan amount to the value of the property being financed. A higher LTV ratio may be associated with higher interest rates, as it represents a higher level of risk for the lender.

- Lender risk tolerance: Different lenders may have different risk tolerances and underwriting criteria, which can affect the pricing of a commercial loan. For example, a lender that is willing to take on higher levels of risk may offer more favorable loan terms compared to a lender with lower risk tolerance.

Type of Commercial Mortgage Services

There are many different types of commercial mortgage services that can be provided by commercial mortgage lenders, brokers, and other financial professionals. Some common types of commercial mortgage services include:

- Financing for the purchase of commercial real estate: This type of service involves providing financing to businesses and investors to help them purchase commercial properties, such as office buildings, retail spaces, and warehouses.

- Refinancing of existing commercial mortgages: This type of service involves helping businesses and investors to refinance their existing commercial mortgages to secure better loan terms or to access additional financing.

- Bridge loans: A bridge loan is a short-term loan that is used to bridge the gap between the purchase of a property and the completion of a permanent financing arrangement. Bridge loans can be used to finance the purchase of commercial properties.

- Construction loans: A construction loan is a type of loan that is used to finance the construction of a commercial property. These loans are typically short-term and are paid off once the construction is complete and the property is sold or refinanced.

- Permanent financing: Permanent financing is a long-term loan that is used to finance the purchase of a commercial property. This type of financing is typically provided after a construction loan or bridge loan has been paid off.

- Mezzanine financing: Mezzanine financing is a type of financing that is used to provide additional capital to businesses or investors for the purchase or renovation of commercial properties. It is typically structured as a second mortgage or a loan that is secured by the equity in the property.

How should you save on commercial loan expenses?

There are several ways by which the Commercial loan provider Truerate Services helps you to potentially save money on a commercial loan:

- Shop around: Truerate Services is a platform that helps you to save on a commercial loan by shopping around. Compare rates and terms from multiple lenders. This helps you to get better offers at better rates.

- Improve your credit score: A higher credit score may help you qualify for more favorable loan terms, including lower interest rates. To improve your credit score, consider paying your bills on time, reducing your credit card balances, and disputing any errors on your credit report.

- Choose a shorter loan term: In general, shorter loan terms may be associated with lower interest rates. By choosing a shorter loan term, you may be able to save money on interest over the life of the loan.

- Make a larger down payment: A larger down payment can help reduce the amount of the loan and may also result in lower interest rates.

- Consider a fixed-rate loan: Fixed-rate loans have interest rates that remain the same throughout the loan term, which can provide stability and predictability. By contrast, adjustable-rate loans have interest rates that can change over time, which can make them more risky and potentially more expensive.

Commercial Loan Truerate Services to provide Investment Sales and Capital Market Services

Commercial Loan Truerate Services have launched Investment Sales and Capital Market Services along with providing commercial loans. They will use or sell financial instruments such as stocks, bonds, and other securities to raise capital for businesses and other organizations. TrueRate’s tools and resources will be used by businesses and investors as part of a broader capital-raising strategy. TrueRate’s tools and resources could be used by businesses and investors as part of a broader investment strategy.