In Need of a loan? Want to get an assured loan quickly and easily? Then try offering secured collateral to the banks and get loans processed with a 90% guarantee. There are different types of collateral in secured form. Collateral is basically an assurance in the form of any asset which is of value to the lender against which he will lend a loan to you. Any type of credit is risky but when it offers security to the lender, they become attractive against unsecured credit. Let us learn more about the types of secured loans or collateral.

Suppose you have surplus cash & your close family friend is in great need of money. You are willing to lend him money but you want to play safe. Thus in return, you ask him for his car keys as security (secured collateral). In case he is not able to return your money you can sell his car to recover some amount. In a way, you hedge your risk with secured collateral. Let’s discuss different types of Secured collateral in detail:

Table of Contents

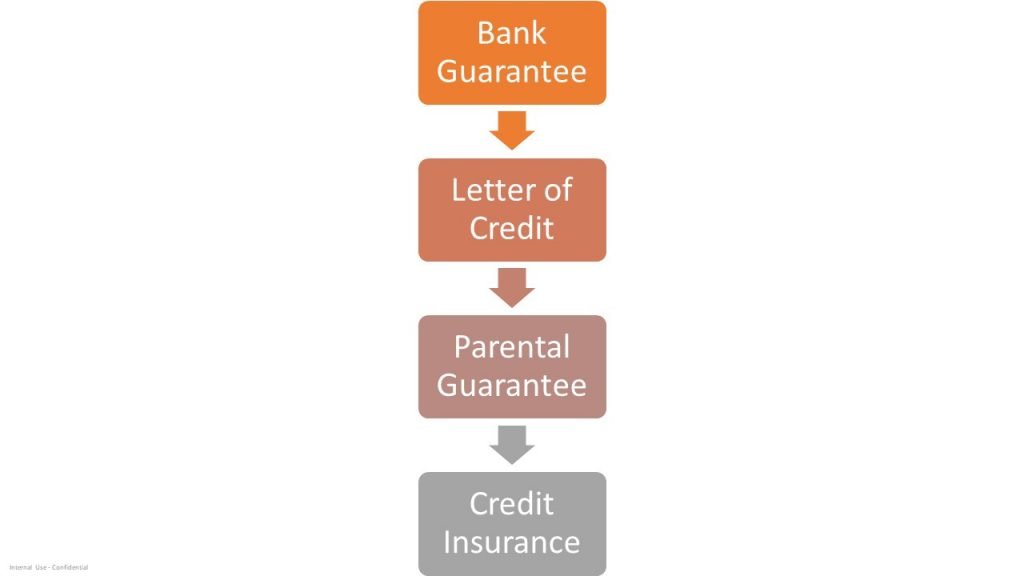

Bank Guarantee

Offer a bank guarantee to the lender to get a quick loan. A guarantee from a lending institution ensures that the liabilities of a debtor will be met. In other words, if the debtor fails to settle a debt, the bank will cover it. A bank guarantee enables the customer (the debtor) to acquire goods, buy equipment, or draw down loans. Thereby expanding business activity. The processing charges are usually met by the customer. It is very popular form of secured collateral.

Letter of Credit

Letter of Credit or LC is usually a popular mode of secured collateral accepted from corporates to extend business loans.

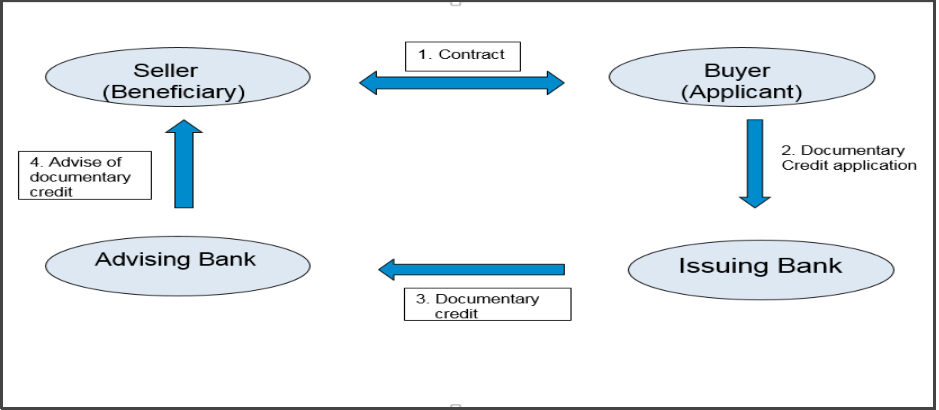

- Letter of Credit “LC” (as it is commonly referred to) is a payment undertaking given by a bank to the seller. It is issued on behalf of the applicant i.e. the buyer.

- The Buyer is the Applicant and the Seller is the Beneficiary. The Bank that issues the LC is referred to as the Issuing Bank which is generally in the country of the Buyer. The Bank that Advises the LC to the Seller is called the Advising Bank which is generally in the country of the Seller.

- The specified bank makes the payment upon the successful presentation of the required documents by the seller within the specified time frame. Note that the Bank scrutinizes the ‘documents’ and not the ‘goods’ for making payment.

- Thus the process works both in favor of both the buyer and the seller. The Seller gets surety that if documents are presented on time and in the way that they have been requested on the LC the payment will be made. The buyer on the other hand also gets surety that the bank will thoroughly examine these presented documents and ensure that they meet the terms and conditions stipulated in the LC.

- LC is transaction-based and refers to a particular transaction or set of transactions, whereas BG is revolving and is not transaction-specific.

Executing a Letter of Credit

- A seller will get the payment only after performing specific actions that the buyer and seller agree to.

- For example, the seller may have to deliver merchandise to a shipyard in order to satisfy requirements for the letter of credit. Once the merchandise is delivered, the seller receives documentation proving that he made the delivery. The letter of credit now must be paid even if something happens to the merchandise. If a crane falls on the merchandise or the ship sinks, it’s not the seller’s problem.

- To pay on a letter of credit, banks simply review documents proving that a seller performed his required actions. They do not worry about the quality of goods.

Parental Guarantee( CG/PG)

A corporate Guarantee or Parental Guarantee is a widely accepted form of secured collateral accepted for extending loans to corporates.

- CG is a guarantee given by a group company for the payments to be done by their subsidiary/affiliate.

- It can be insisted in case the financials of the subsidiary is not provided. Even if the subsidiary is newborn.

- CG can be accepted only if the parent company’s financials are strong enough.

- The risk that CG covers are to approach the group/parent company in case the subsidiary delays or defaults in the payment. Thus the parent will have to pay us.

Credit Insurance

Another widely used secured collateral is Credit Insurance which any individual can produce as security to get quick loans from banks or financial institutions.

- An insurance policy and risk management product that covers the payment risk resulting from the delivery of goods or services.

- Usually covers a portfolio of buyers and the risk arising out of default in payment by these buyers (i.e., protracted default, insolvency, or bankruptcy).

- The cost (known as “premium”) for this is a monthly charge, which is calculated as a percentage of sales of that month. Also as a percentage of all outstanding receivables.

- Bankruptcy, insolvency, Protracted default by the customer, and Political risks are covered as losses.

Above are different types of secured collateral

Benefits of using a Secured Collateral

Below are the advantages of a secured form of collateral:

1. Quick easy loan approval – The majority of the loan applications get rejected because of no secured collateral offered against the loan. The credibility of the borrower is questionable, but if an asset is pledged against the loan, the lender has the option to recover the money in case of any default.

2. Convenient – Secured collateral has made loan processing easier. it is fast, hassle-free, and convenient.

3. Lower risk – The risk of default is minimized to a great extent due to secured collateral offered.

4. Works even with a low credit score – If you are willing to offer secured collateral, in spite of your low credit score, the chances of getting loan approved is much higher.

FunFacts

Banks ask for secured collateral for businesses, only if they offer assets worth equal to or at least 80% of the loan amount asked for.

Have you got your loan faster or not?

Buy Waterproof, Durable, and Strong Dog Collar