June month is flooded with new IPO’s, but which one is good to pick? India Pesticides Ltd IPO will be out on Jun 23, 2021, and closes on Jun 25, 2021. The issue is priced at ₹290 to ₹296 per equity share. Should you pick this one? Let’s understand if you should subscribe to India Pesticides IPO or not?

Table of Contents

Company Background

IPL is engaged in the manufacturing of various types of pesticides (technical & formulations) and pharmaceutical intermediates. Pesticides contribute about 92% of total sales, while pharmaceutical intermediates contribute about 8% to the total sales of the company. The company have obtained registrations and license to manufacture from CIBRC and the Department of Agriculture Uttar Pradesh for 22 agrochemical Technical and 124 Formulations for sale in India and 27 agrochemicals Technical and 34 Formulations for export. It has won many awards including the top exporter award from CHEMEXIL in the past. The company is recognized for its exports. The R&D facilities of the company are registered with the Department of Scientific & Industrial Research (DSIR) for both the plants. The company has registered significant growth in the past few years on the back of its ability to register its molecules in 25 countries along with healthy domestic demand.

COVID Impact

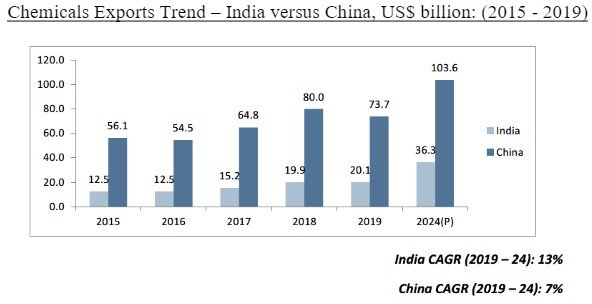

The pandemic had a limited impact on crop planting patterns and crops like wheat, rice, and soya bean have shown strength. The domestic agrochemicals sector has a good opportunity to gain considerable market share in the global markets as customers are looking to diversify their supplies away from China. The industry is also trying to engage in backward integration for the manufacturing of technical grade pesticides as it wants to shift its reliance from China and become self-sufficient in the coming years.

Credit Rating

Credit Rating as per CARE as of March 2021 is A with a Stable outlook, and the previous 3 year’s rating has also been stable with no red alerts.

Financial Highlights from 2018 to September 2020

- Non-Current Assets– It increased by 39% from 2018 to September 2020, whereas 9% increase YoY. Increase in Fixed assets was increased considerably

- Inventories – It increased by 207% from 2018 to September 2020. Signifies high demand for products

- Increased Sales on Credit– trade Receivables increased by 80%. This implies sales on credit was high

- Cash Balance – Total cash balance increased by 2146%. Thus this company turned cash-rich

- Total Equity also increased by 129%

- Borrowings decreased by 62%

- Total Revenue increased by 30%

- Total Expenses increased but only by 16%

- Profit after Tax increased by 121%

- Cash flow from operations increased by 206%

Inferences & Insights

- India Pesticides Ltd was able to increase its revenue by 30%, but at the same time was able to manage the expenses (increase only by 16%) and beat inflation thanks to their R&D facilities.

- The company was able to reduce its borrowings, which is important to reduce fixed obligations

- Sales have increased taking the route of credit sales and taking advance of working capital management in efficient way. Thus, translating into increased production and increased inventories

- Surplus cash always helps in absorbing any shocks or meeting emergency situations

- Cash Flow from operations increased by 206% but PAT did not increase equivalent to that. This is because cash flow from investing and financing activities both are negative and has not yet turned positive, in fact, the losses have increased. This is a concern, however, with effective management, these can turn positive in the long run.

Subscribe or Not?

Yes, We recommend you to subscribe to India Pesticides IPO. Looking at its Financials and Credit Rating historically, the prospects of this company look bright and promising.

Strengths

- Growing export demand for pesticides globally

- Supply chain interruptions with China on account of the COVID-19 crisis

- Incentives offered by the Government of India to produce agrochemicals to boost agricultural production

- Strong liquidity position and profitable company with substantial growth YoY

- Research & Developments done contributing to improved products at low-cost benefits

Challenges

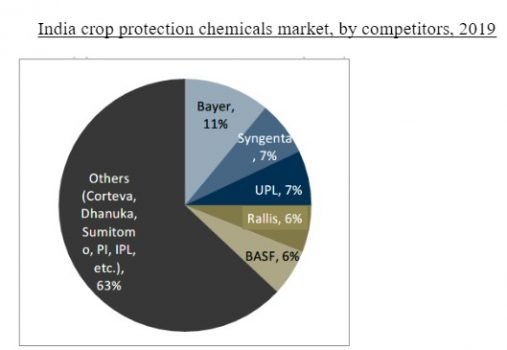

- Strong competition from competitors in the market

- Foreign currency exchange risk

- Huge working capital requirement- need to maintain high inventory and long credit period

- Seasonal demand – dependence on climatic conditions

Stock Market Tip– Do subscribe to IPL IPO

The strengths listed overweighs the challenges called out. Thus, we highly recommend subscribing to IPL IPO.

Short term or Long-Term Hold

We recommend holding these shares for the long term. As exports of pesticides will increase as dependence on China reduces. Thus, holding for the long term will help you multiply your money. These shares also look good from receiving Dividends. Holding these for the short term might only give you listing gains.

Smart Finance Tip – Buy and Hold India Pesticides Ltd (IPL) shares for the long term. Allocate 10% of your portfolio to this stock.

Products at the lowest cost are available for a limited time!