With cash, comes purchasing power, liquidity, and cushion to absorb shocks. Cash Inflow and Outflow are important factors to determine the cash position of any firm. It is vital to meet short-term obligations. To understand the financial health of any company, financial analysis involves squeezing underlying information from the Cash flow statements or Fund Flow statements. Let’s increase our financial quotient “FQ” and understand the purpose of cash flow analysis or Fund Flow Statement Analysis in detail.

Table of Contents

What is a Cash Flow Statement?

A Cash Flow Statement is a financial statement that is prepared by corporates for a specified time period. Cash Flow Statement reflects the cash position of any company by breaking down Cash Flows under 3 heads:

- Cash Flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities.

Consider Cash Flow Statement as the breakup of the company’s cash income and expenses displayed in the form of a statement with all the details of cash inflows and cash outflows for a specified time period. This statement is very important to do quick cash flow analysis which measures various financial performance metrics of a company used for checking the financial health of the company. The resultant figure shows whether the company has a positive net cash balance or a negative balance thus reflecting its ability to meet obligations.

To understand the purpose of cash flow analysis, let’s consider a scenario–

My friend is 28 years old, working in an MNC. For him, the salary credited to his account every month is Cash flow from operating activity- as it’s coming from his main occupation. Now he has invested some of his family’s savings in buying an apartment & renting it. The monthly rent that he gets becomes his cash flow from investing activities. Lastly, he also bought some shares of Blue-chip companies, so dividends that he gets out of them can be termed as cash flow from financing activities.

Cash Flow Analysis

Cash flow analysis is like deep-diving into the Cash flow statements to understand which activities require an immediate focus. It is a preventive and proactive analysis to identify the issues and take measures to overcome them. Focus on those sets of activities that are not producing desired results be it core operations, or investing or financing decisions so as to change the strategies around it and check for improved outcomes.

Cash Flow Analysis in 10 minutes :

- If cash flow from operating activities is positive then the company’s future is bright, as it is able to generate revenue from its core operations. However, if this figure itself is negative then the company’s management needs to take a step back and understand if they have the right business model in place or not. This is an important financial figure, as the company should be earning out of its main business, rest becomes secondary.

- If the cash flow from investing activities is positive then the company has the right investing strategy in place. If this figure is negative then the company needs to hire the right investment advisors. Investments in real estate, machinery, etc are capital expenditure thus needs a cautious call.

- If the cash flow from financing activities is positive then, the financing activities are in the right direction. However, if this figure goes negative, then the company needs better financial advisors. Fundraising activities, issues, or redemption activities should be taken judiciously.

- If the Net Cash Balance is negative then the company needs to work hard to turn the overall cash balance positive in the upcoming year. If it is negative because of any one of the 3 cash flows then concentrates on those set of activities. Thus if the overall net cash balance is positive, but any of the 3 cash flows are negative, even then the company needs to focus on the one which has gone wrong.

Cash Flow Analysis

| Cash Flow Analysis | ||||

| Cash flow from operating activities | + | - | + | + |

| Cash flow from investing activities | + | + | - | + |

| Cash flow from financing activities | + | + | + | - |

| Net Cash Flow | + | + | + | + |

| Cash Flow Analysis | No issues | Focus on core business | Focus on Investing activities | Focus on Financing activities |

| Cash flow from operating activities | + | - | + | + |

| Cash flow from investing activities | + | + | - | + |

| Cash flow from financing activities | + | + | + | - |

| Net Cash Flow | + | - | - | - |

| Cash Flow Analysis | No issues | Focus on core business | Focus on Investing activities | Focus on Financing activities |

Cash from Operating activities

- It includes measuring the cash inflows and outflows caused by core business operations

- Calculated by adjusting the Net income. Common Adjustments include Depreciation, Profit / Loss on Sale of Financial Assets, Changes in Working Capital (excluding cash), etc.

Example – A company manufacturing furniture is earning well from selling furniture which is its main or core business.

Cash from Investing activities

Changes in equipment, assets, or investments relate to cash from investing. Usually, cash changes from investing are a “cash-out” item. It is because you need cash to buy new equipment, buildings, or short-term assets such as marketable securities. However, when a company divests an asset, the transaction is considered “cash in” for calculating cash from investing.

Example – A company that has purchased a building for its operations, is an investing activity.

Cash from Financing activities

Changes in debt, loans, or dividends are accounted for in cash from financing. Changes in cash from financing are “cash in” when capital is raised, and they’re “cash-out” when dividends are paid. By accepting Fixed deposits from Public or known parties, the company receives cash financing. However, when fixed deposit holders receive interest on their deposits, the company is reducing its cash.

Example – A company issuing equity shares to raise funds is a type of financing activity.

Purpose of Cash Flow Analysis

Comparing a company’s cash flow against its industry peers is a good way to gauge the health of its cash flow situation. The company not generating the same amount of cash as competitors will eventually lose out when time gets rough. Thus cash flow analysis of a company reveals a lot about the company’s financial health.

- Comparing the amount of cash generated to outstanding debt, known as the operating cash flow ratio (CFO/CL), illustrates the company’s ability to service its loans and interest payments.

- If a slight drop in a company’s quarterly cash flow would jeopardize its loan payments, that company carries more risk than a company with stronger cash flow levels.

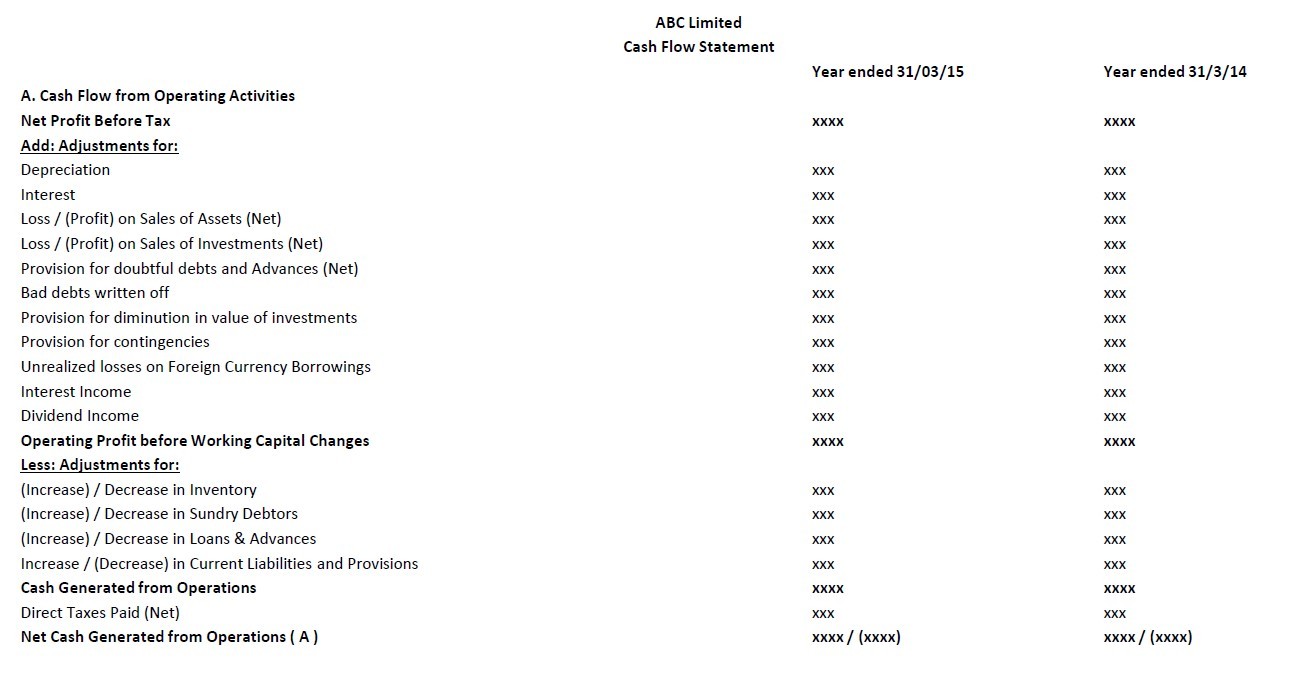

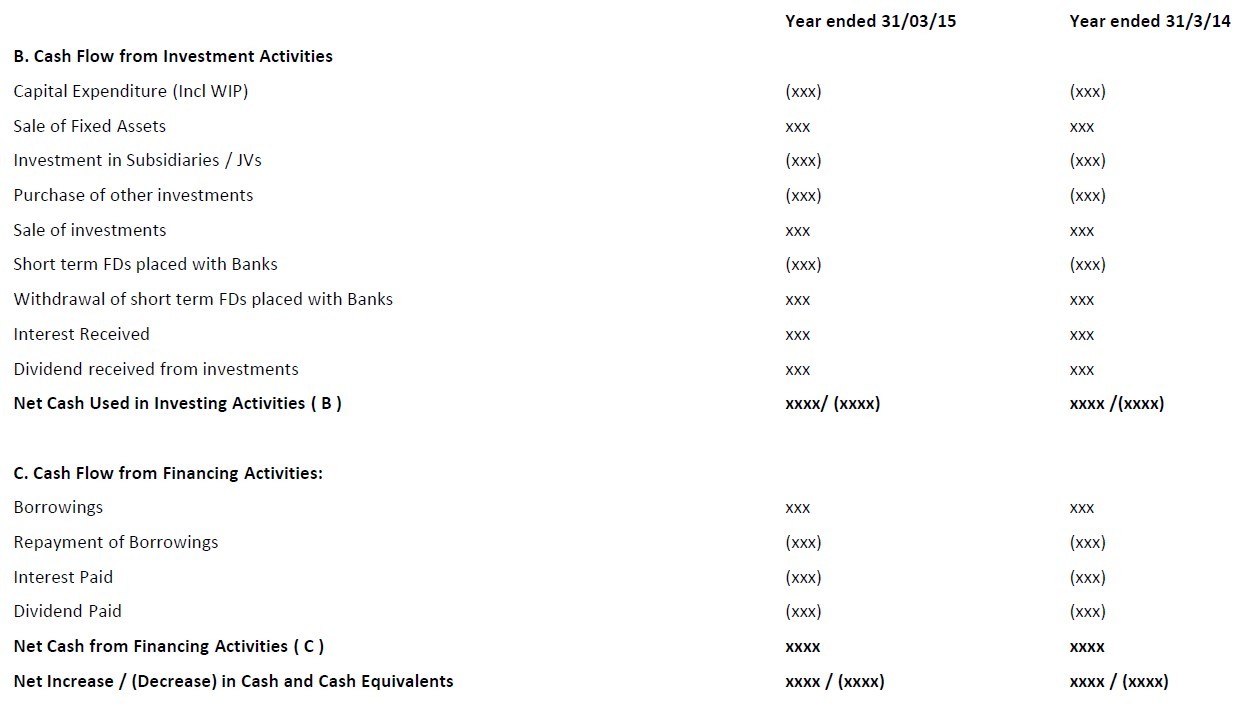

Cash Flow Statement Format

FunFact

Apple is the company with the highest Free Cash Flows $7.17 billion in 2020, followed by Verizon with $2.11 billion FCF (Free Cash Flow)

What are your thoughts on Cash Flow Analysis?