Imagine you go to a wedding party & start judging all based on looks, clothes, fashion sense, etc. Thus you are analyzing people around you based on various criteria right. Similarly, you can develop a futuristic opinion about the company’s performance by looking into its financial figures. Analysis of any Financial statement comprises of studying their balance sheet, P&L & Cash Flow statements to know the firm’s overall financial performance & determine its futuristic proposition. Let us discuss what parameters can help you with a quick financial analysis. Analysis of any Financial statement comprises of most common tools Historical trend analysis, financial Statement analysis & Ratio Analysis.

Table of Contents

Profitability

Income should be more than the total cost incurred. The ability to earn an income consistently is important. Sustained growth in both short-term and long-term matters. Also Applying the assets effectively and profitably (Profit & Loss/Income Statement).

Solvency

Pay what is due on time. The ability to pay the obligation to creditors and other third parties in the long-term (Balance Sheet).

Liquidity

Cash helps to absorb any shocks. The ability to maintain positive cash flow, while satisfying immediate obligations (Balance Sheet).

Stability

Withstand competition and seasonal fluctuations. The ability to remain in business in the long run, without having to sustain significant losses in the conduct of its business (P&L & Balance Sheet).

Comparisons within the industry

Peep into your competitor’s financial figures. Compare accounting numbers to those of similar companies in the same industry (Cross-Sectional analysis)

Comparison within the Financial statements

Common-size Financial Statements-Represents relationship of different items of financial statements with some common item by expressing in %.

Therefore analysis of any Financial statement comprises of above parameters of factors to be taken into consideration.

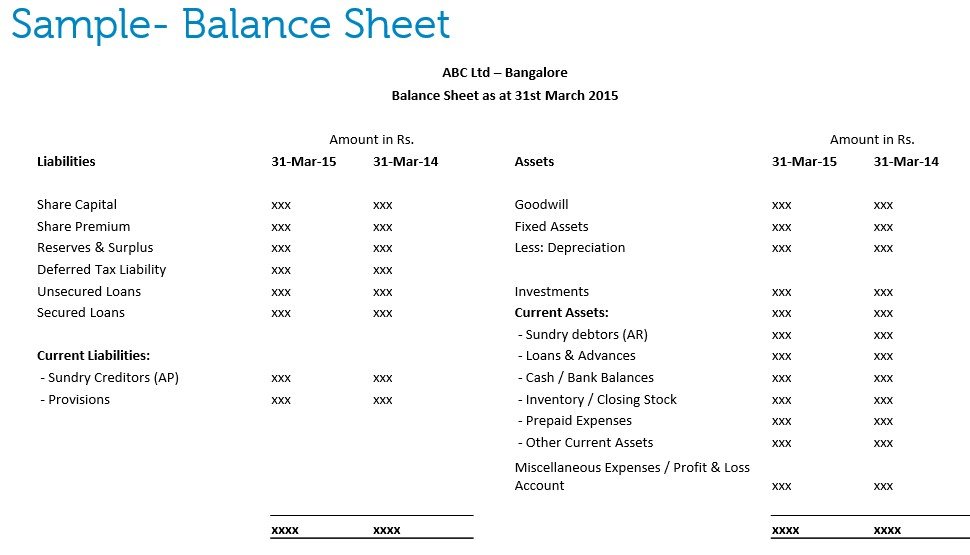

Balance sheet analysis

It involves analyzing Net worth, Net working capital, Cash and Bank, Free Reserves. Also involves important analysis of below parameters-

- Tangible Networth (TNW) – Shareholders’ funds or Own funds of the company. (Share Capital + Reserves & Surplus + Deferred Tax Liability – Deferred Tax Asset – Accumulated losses if any)

- Quasi Networth – TNW + Unsecured loans from promoters/shareholders

- Long term debt – Borrowed from Banks, FIs, and others (example- Term loans, Project loans, Unsecured loans)

- Current Liabilities – Short term funds that the company owes to others (example-Creditors, Provisions)

- Contingent Liabilities – Guarantees on loans taken by group companies, Non funded limits like LC/BG (contingent liabilities appear in the notes of accounts and not in the balance sheet)

Application of Funds

- Fixed Assets minus Depreciation (e.g. Land, Plant & Machinery, Furniture)

- Investments – funds invested by the company in group companies, other entities, Short term or long-term investments like equity, mutual funds, etc

- Current Assets – Short term funds that others owe to the company or which can be liquidated immediately (e.g., Debtors, Loans & Advances, Inventories, Cash/Bank Balance)

Profit & Loss Analysis (P&L)

It involves analyzing ratios, cash flows, debt & credit of all items. Below are some of the important analysis figures:-

- Sales – Y-o-Y growth in Sales

- Gross Profit % on Sales

- Net Profit or PAT % on Sales

- PBDIT– Profit before Depreciation, Interest, and Tax

- Cash Profits – PAT + Depreciation

Analysis of any Financial statement comprises studying all the above statements in-depth to understand the hidden financial health of any company.

FunFacts

Back in History, people used to track their daily profit or loss incurred due to the barter system. Later with the evolution of the monetary system, an organized form of the double-entry system gave birth to a formal Profit & Loss statement & Balance sheet.

Buy waterproof travel bag for newborns at the lowest cost