Should you subscribe or avoid Valiant Laboratories IPO? It will be out on Sep 27, 2023, and closes on Oct 3rd, 2023. Below are some of the important dates and details:

| IPO Details | Dates |

| IPO open date | Sep 27, 2023 |

| IPO close date | Oct 3, 2023 |

| Price band | Rs 133 – Rs 140 |

| Minimum lot quantity/shares | 1 lot/105 shares |

| Allotment date | Oct 5, 2023 |

| IPO listing date | Oct 9, 2023 |

Table of Contents

Purpose of usage of Valiant Laboratories IPO funds:

Below are the ways how the company intends to use the proceeds from IPO.

- Investment in its subsidiary – Investment in Valiant Advanced Sciences Private Limited (VASPL) for part financing its capital expenditure requirements in relation to the setting up of the Proposed Facility. Investing its working capital requirements as well.

- General corporate purposes.

Background & Business – Valiant Laboratories

It is Active Pharmaceutical Ingredient (“API”) / Bulk Drug manufacturing company having focus on manufacturing of Paracetamol. Bulk drugs/Active Pharmaceutical Ingredients (API) serve as raw materials for manufacturing finished dosage forms or formulations. Paracetamol (Scientific name: Acetaminophen or para-hydroxy acetanilide – C8H9NO2), is one of the most commonly taken analgesic worldwide and is recommended as the first-line therapy in pain conditions by the World Health Organization (WHO).

Government incentives:

With the newly announced schemes, the Indian government is also looking at creating common infrastructure facilities and reduce dependence on some critical drugs.

- Production-Linked Incentive – Tenure: FY21 to FY30. Financial outlay: Rs. 69.4 billion. Scheme is applicable for greenfield projects. Financial incentive to be provided for 41 identified key

products which cover all 53 identified API’s. The net worth of applicant (including that of group

companies) as on date of application >=30% of total proposed investment. Maximum number of selected applicants: 136. The incentive under scheme shall be applicable only on sales of eligible product to domestic manufacturers. - Creation of API and intermediaries parks – Tenure: FY21 to FY25. Financial outlay: Rs. 30 billion

Three API and intermediaries parks will be supported under the scheme. Maximum grand-in-aid for one API and intermediaries park will be limited to Rs. 10 billion. Minimum 50% of land area for API and intermediaries manufacturing units . 3 states to be selected through challenge method.

Forecasted Growth:

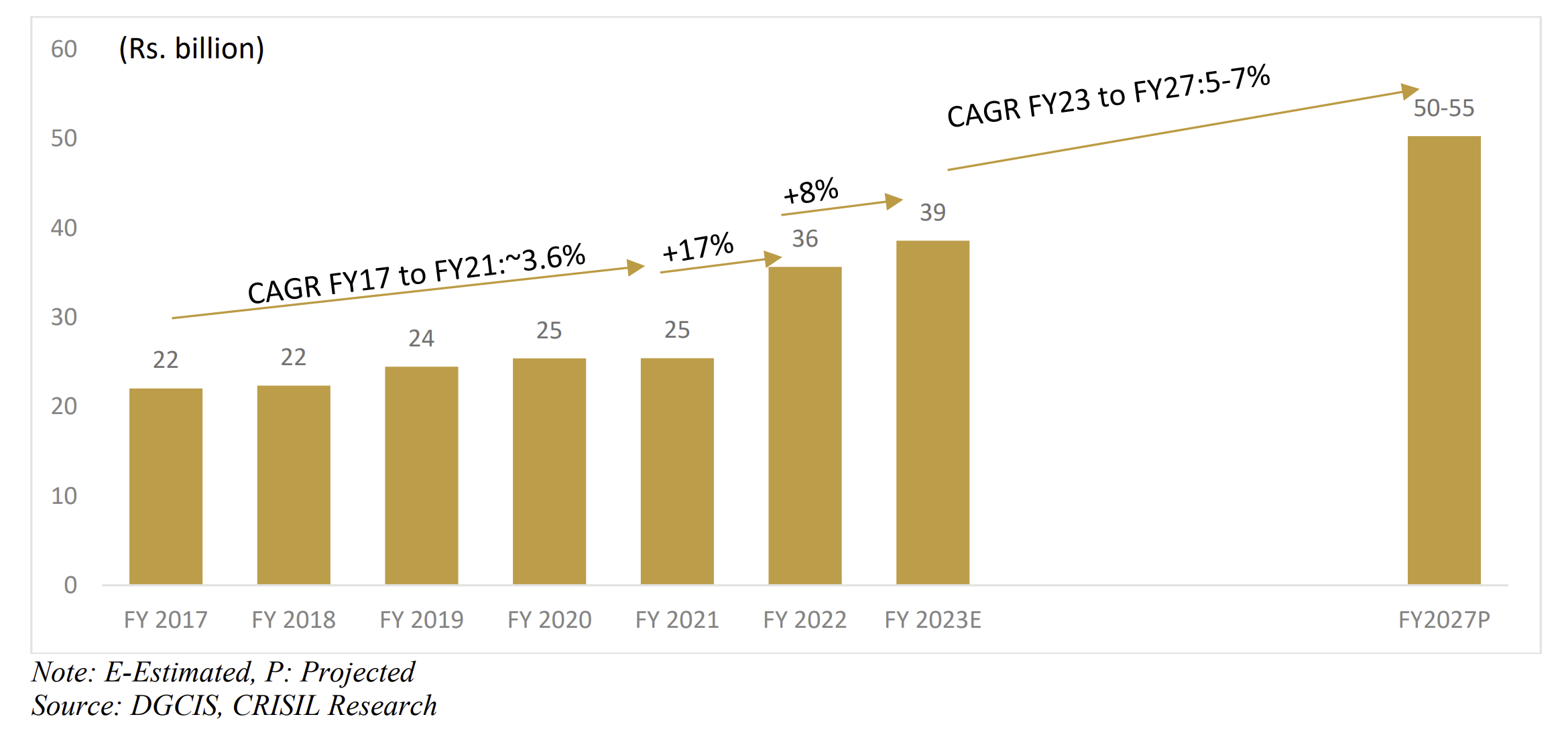

Paracetamol API industry in India to grow at 5-7% CAGR between fiscal 2023 and 2027

The paracetamol API industry (Domestic consumption+ exports) grew from Rs. 22 billion in fiscal 2017 to Rs.39 billion in fiscal 2023.The paracetamol API market growth was mainly supported by growth in pain and analgesics therapy area which focuses on treatment of common fever, cough and cold as well as volume rise coupled with strong realization levels for players. The paracetamol API demand saw uptick in fiscal 2022 owing to pent up demand due to covid-19 and extensive usage of common cold and fever drugs during the second wave of covid-19. Also, the boost in export demand due to supply restrictions in China gave opportunities for Indian manufacturers to tap the potential export market.Some of the paracetamol API based products saw huge demand during the pandemic giving rise to the strong

demand in the domestic market. Increased sales of these fever medicines saw demand for domestically

manufactured APIs in fiscal 2021 and fiscal 2022.The past growth in the paracetamol API has been

supported by moderate increase in the volume consumption coupled with the price rise.

Going forward the paracetamol API industry is expected to clock a CAGR of 5-7% between fiscal 2023 and fiscal 2027, largely driven by the demand from domestic formulation manufacturers as well as export markets. The demand in the domestic market can be attributed to rise of OTC segment and self-care for some of the common ailments like fever and cold which are key application areas for paracetamol API as well as price rise caused by the rising raw material costs for manufacturing paracetamol API. The price rise in the paracetamol API space is often reflected in the formulation price rise of formulations which is often revised to the tune of wholesale price index for the year 2022 the WPI was ~10% and hence going forward price rise is expected in paracetamol formulations market which will also see similar price rise trend in the paracetamol API market.

The overall API industry in India grew from Rs. 781 billion in Fiscal

2017 to Rs. 1,179 billion in Fiscal 2022 registering a CAGR of 8.5% in rupee terms. Going forward the

API industry is expected to clock a growth rate of 9-11% between Fiscal 2022 and Fiscal 2027, largely

driven by growth in API exports, which is expected to deliver a healthy growth during the period under

consideration.

Below are the factors responsible for such growth:

Per capita consumption of chemicals in India is lower compared with western countries. Hence, there

is considerable scope for new investment

• A large population, huge dependence of the domestic market on agriculture, and strong export demand

are the industry’s key growth drivers

• The shift in the geopolitical landscape and global supply chain preference from China can provide

India with a platform for converting challenges into opportunities

• The domestic market has significant growth potential with rising GDP and purchasing power

• World-class engineering and strong R&D capabilities.

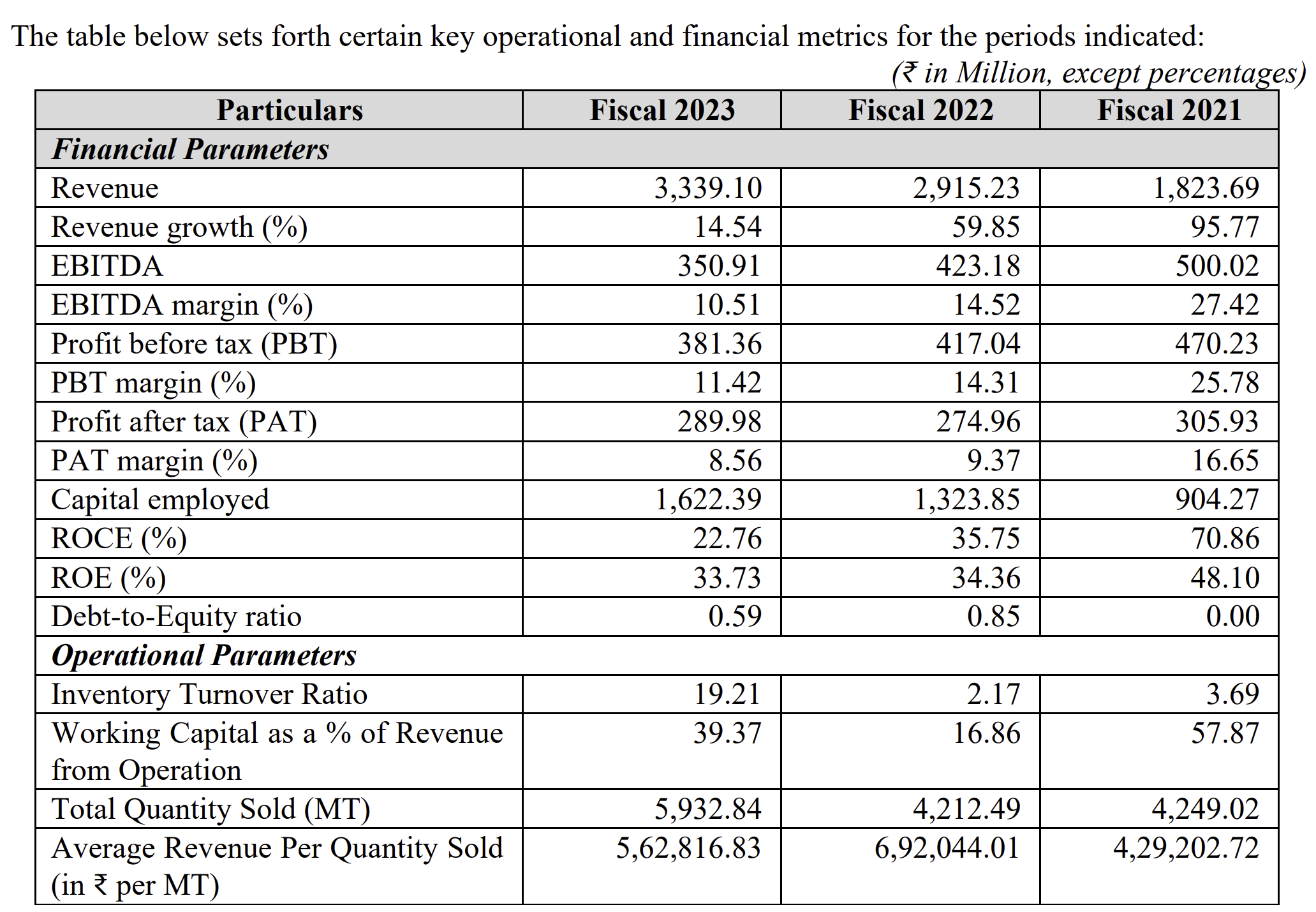

Financial Highlights of Valiant Laboratories

Strengths of Valiant Laboratories IPO

- India enjoys cost advantage over regulated markets – API and intermediaries manufacturing costs are significantly lower in India than in the regulated markets of he United States (US) and Europe.

- The manufacturing landscape for paracetamol API industry in India is concentrated with presence of few players hence competitive advantage.

- Export demand is very high.

- The company is planning to invest the proceeds in its subsidiary to increase its production and meet its working capital needs. This would further ensure growth in operating profits.

Challenges of Valiant Laboratories IPO

- Unionization, work stoppages or increased labour costs, which could adversely affect their business and results of operations.

- High competition from established competitors.

- Comply with various national and local laws and regulations.

- Competitive pricing.

- Ensure compliance with various rules, laws and regulations.

Valiant Laboratories IPO – Subscribe or Not?

Limited money investors – Go for listing gains if the market is bullish else Avoid it.

Risky investors with enough money – Subscribe for the long term.

Short term or Long-Term Hold

If you still want to buy Valiant Laboratories IPO shares then go for the long term. Holding these for the short term might not give you desired appreciated value.

We recommend you enroll in our Stock broker trading course which will help you to pick the rewarding IPO and earn huge profits.

What is your opinion about Valiant Laboratories IPO?

Disclaimer – Investing in the stock market is subject to market risk, thus kindly consult your financial advisor before investing or consult our financial advisor 😊