Nothing in this world comes for Free! There is a cost attached to everything. The concept of cost accounting stems from the fact of how important a cost is. Cost Accounting was introduced to accumulate information to determine the cost incurred in producing a product, providing a service, or setting up a process in accordance with the objectives of cost accounting. Every business would like to keep a tab on the expenses, as lower the cost, higher is the profit, of course, keeping sales as constant. Analyzing cost would help the management to resort to innovative ways to cost control, without impacting the quality of goods and services produced.

Table of Contents

What is Cost Accounting?

Cost is an expense that is incurred to attain a particular objective. Cost Accounting involves accountants collecting, analyzing, and interpreting information closely related to the overall cost structure. Any decision taken by the management of the business is based on analysis and results, thus cost accountants help them to provide a thorough analysis of every aspect of the cost incurred. The objectives of cost accounting accomplished are cost control, cost reduction, maximizing profit, etc. Cost Accounting is vital to improve operations efficiency.

Cost Systems used under Cost Accounting are Unit costing, Batch Costing, Process costing, Contract Costing, and Operating Costing. There are four techniques or methods of Cost Accounting as well which are Marginal Costing, Cost Volume Price Analysis (CVP analysis), Budgetary Control, and Standard Costing. All of them are consistent with the objectives of Cost Accounting.

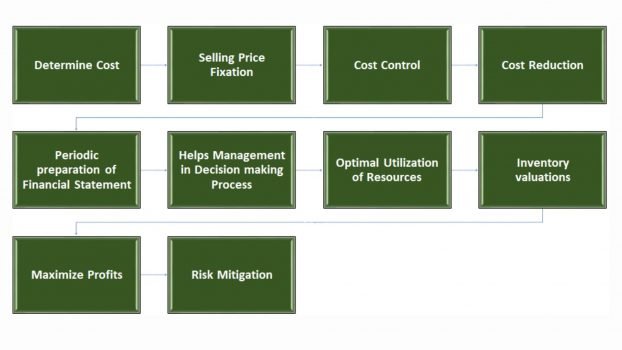

Objectives of Cost Accounting

Cost Accounting is undertaken by the cost accountants to accomplish the determined objectives of Cost Accounting. These objectives are strategized by the higher level of Management to suit their needs and strategies. The Basic objective of Cost Accounting is to control cost control and cost reduction. Below are some of the objectives of Cost Accounting:

- Determine cost

The Cost Accountants are supposed to identify the sources of expenses and collect information to determine the cost incurred in the production of a product or providing a service. Various stages of production and expenses associated with each take place. Cost allocation takes place where it is difficult to determine the exact expenses incurred. Example – Electricity consumed by machinery, may not tell you the exact units of electricity consumed, so cost allocation will be done based on the number of products manufactured through it. Different techniques might be used to determine cost like marginal costing system, standard costing system, etc.

2. Selling price fixation

Business is a profit-making organization. It needs to sell its product or service at a price that is higher than the cost price, after adding a profit margin to it. Once the cost is determined, then steps are taken to identify the right selling price, at which the products or services will be sold to the customer, taking into account competitors’ strategies, economic conditions, etc. Amongst all the cost price becomes the base or floor price, below which the selling price cannot be set. Thus, Cost Accounting plays an important role in setting the right selling price.

3. Cost control

This is the basic objective of Cost Accounting. Cost control is the outcome of Cost Accounting process. Once the overall cost structure is presented, the processes that consume more cost are identified, then using costing techniques like budgetary control, cost control is possible. Budgets are pre-determined, the actual cost is compared with the forecasted cost, if any variance exists, then steps are taken to investigate and control the cost.

4. Cost reduction

Constant cost reduction is achieved through adopting cost control measures. Cost Accounting will help to provide cost data. This when further analyzed and investigated upon, will open room for brainstorming to suggest innovative ways of reducing the cost. Cost reduction in no way means compromising on the quality of products or services provided to the consumers. For example – Automating invoicing process could save time, as well as the cost of employees involved in that process and this does not compromise on quality. This is another main objective of Cost Accounting.

5. Periodic preparation of the financial statement

Cost Accounting produces weekly, month, and yearly reports related to inventories, work in progress, etc. These reports help in preparing budgets and financial statements. It helps in constant monitoring of the financial performance of any business and taking corrective action if required. Year-end financial statements will not help in identifying issues early and taking corrective steps.

6. Helps management in the decision-making process

Critical decision-taking takes place after reviewing the overall cost structure. To increase operational efficiency, it is vital to study the cost incurred on various processes from starting till the end. Then decide on which recurring expenses can be reduced.

- Cost Volume Analysis focuses on optimum utilization of resources.

- Decisions of purchasing raw materials in bulk from cost effective suppliers are taken.

- In case of natural calamities like covid-19, cost analysis helps to determine whether to continue to operate a loss, or to shut down the business makes sense.

- Whether to continue with the same equipment or replace them.

Management makes these timely decisions to ensure overall efficiency.

7. Optimal Utilization of Resources

Cost Accounting helps in identifying the ideal utilization capacity of the machinery, optimal volume production, and an adequate number of employees required to achieve operational efficiency. This way it helps in utilizing resources optimally and reduce wastages. No wastage and optimal utilization would mean cost savings.

8. Inventory valuations

Cost Accounting practices are very popular in manufacturing firms, where huge raw material is procured, which is converted into finished products. Inventory management in these firms becomes a mandate so as to maintain an optimal level of stock to sell. Cost Accounting helps in determining the cost of raw materials used per unit of produced items, cost of work in progress, cost of finished products. Using FIFO, LIFO method of costing helps in inventory valuation. Monitoring inventory is vital for sustaining a profitable business.

9. Maximize Profits

A profit-making firm will sustain only if it continues to generate profits in the coming years. Profit = Selling Price – Cost Price. Profit is directly dependent upon cost. Higher the cost lesser is profit, lower the cost, higher is the profit. When cost accounting is undertaken, cost control and cost reduction being the basic objectives of cost accounting are the byproducts that help in maximizing profits to a great extent. Year on year cost minimization strategies will help in generating profits in the long run.

10. Risk Mitigation

Cost Accounting techniques and methods are used for risk mitigation at all levels. Businesses are prone to uncertainties; it becomes important to limit the risks. Risk of inflation, risk of increased labour prices, risk of fluctuating raw material cost, risk of rising transportation cost, etc are inherent. Cost accounting techniques like Budgetary control, Cost volume price analysis, marginal costing, and standard costing will surely help in mitigating risks.

Difference between Cost Accounting and Management Accounting

Management Accounting involves the application of appropriate techniques and concepts, which help management in establishing a plan for reasonable economic activities and making rational decisions for the accomplishment of these objectives. Any technique whether is drawn from financial accounting, cost accounting, economics, mathematics, and statistics can be used in management accounting.

Below are the differences between Cost Accounting and Management Accounting:

| Cost Accounting | Management Accounting |

| The basic objectives of Cost Accounting is cost control and cost reduction | The basic objective of Management Accounting is to improve the overall efficiency of the organization |

| Uses quantitative techniques or methods | Uses both qualitative and quantitative techniques or methods |

| Based on Financial facts and data | Based on both financial and non-financial facts and data |

| Not dependent upon Management Accounting | It is dependent upon Cost Accounting |

| Cost Accounting principles are used | Financial and Cost accounting principles are used |

| Statutory audit is mandated | Statutory audit is not mandated |

| Decision making revolves around cost structure | Overall decisions related to the organization takes place |

Funfact

The Cost Accounting Software Market is expected to boom Globally to register higher CAGR% by 2027.

Has Cost Accounting affected your business ever?