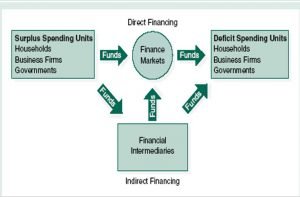

When you earn money, then part of that money goes into paying your monthly rent, buying groceries, paying utility bills, traveling, for personal expenses, etc. Whatever remains if any becomes your saving. The same vicious cycle continues, where you collect money from a source and allocate it amongst different resources. In this process, you tend to generate income sources while spending your earned money. Similarly, the Indian Financial system has an orderly mechanism and structure to mobilize the monetary resources or capital from various surplus sectors of the economy and allocate the same into various deficient sectors.

It is a set of well-integrated subsystems of FIs, Markets instruments, and services that facilitate the transfer and allocation of funds, efficiently and effectively.

Evolution of Indian Financial System:

The path of growth of the financial system in any developing economy can grossly be classified into three different phases:

•Active State Intervention – It is mainly with a view to building up institutional infrastructure so that the economy will be in a position to catch up with the developed countries. This phase is marked by a fast growth financial system creating a number of pitfalls and aberrations.

•Partial Liberalisation – The complication in the system is a gross problem to handle, so simplification and rationalization of the system become the main focus.

•Total Liberalisation – Where maximum autonomy is provided for the functionaries in the system so that they can emerge as global players.

Key elements of a well-functioning Indian financial system are:

- Strong legal and regulatory environment-as rules help to maintain decorum.

- Stable money management-talking of the financial system, it should have a good money management system

- Sound public finances and public debt management-again as an economy it will deal with public finances and debt management.

- A Central Bank-a bank that will be ahead of all banks in the financial system.

- Sound banking system-banking system which has sound functioning to channelize resources of the economy in a productive way.

- Information System-it is vital to communicate about the rules, systems to ensure transparency.

- Well-functioning securities market— securities include financial instruments that serve a various purposes.

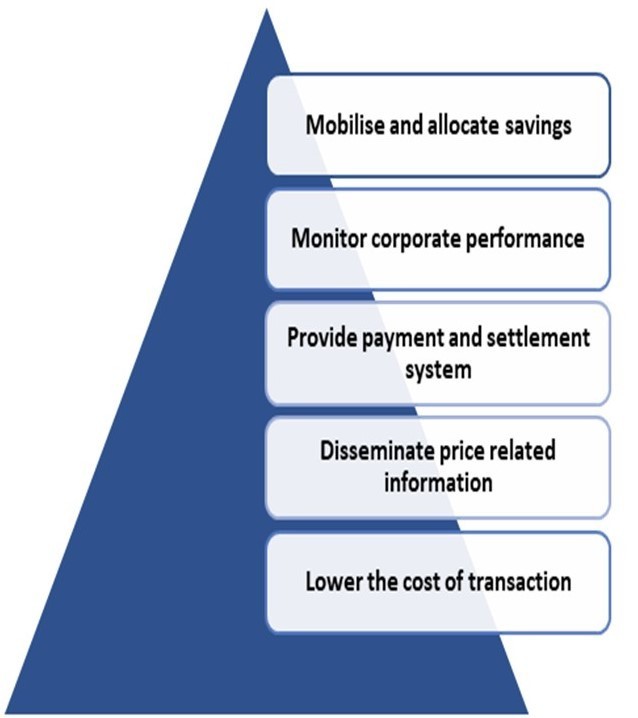

Functions of the Indian Financial System:

- Mobilize and allocate savings-Imagine yourself who collects your income from the company and allocates it to various sources to fulfill your needs. Similarly, there should be organizations to do the same.

- Monitor corporate performance-Again you hear how your friends are trying to save more money and reduce their personal expenses. Then you try to incorporate some of their practices through comparison. Similarly, it’s important to monitor, review the overall corporate performance.

- Provide payment and settlement system– You are able to spend on your expenses without hazels due to auto-debit facility of rent from your account, buying groceries through cash or card, etc. These are possible due to various payment & settlement systems offered today.

- Disseminate price-related information – Creating transparency helps to know the price to be paid for a specific product or service. It’s important to create this transparency which also helps in creating competitive pricing.

- Lower the cost of the transaction – Now if you use your credit card for making payments of groceries, at times we need to pay a surcharge. Whereas paying cash won’t lead to this surcharge, thus lower the cost of the transaction the more widely used it will be.

The above explains how the Indian financial system functions and maintains the balance in the economy.

The growth and development of an economy is a reflection of the growth and development of its financial system. With effective mobilization and productive deployment of funds the economy can ensure faster growth because this efficacy will reduce transaction cost and increase the productivity of capital. Thus more efficient a financial system the stronger is the economy.

Functions of the financial system

FunFacts

In 1991, the Indian Financial System started spreading its roots and it still growing.

Let us know your thoughts on the Indian Financial System?