I know you’ve heard that crypto is going to be a big thing. But how can you start earning from it now? You can’t make money just by buying and holding. Fortunately, there are ways for you to earn a passive income from crypto investments, so that you don’t have to worry about how much your assets are worth–you’ll always have money coming in! These days it is easy to buy cryptocurrencies like Bitcoin and Ethereum with a credit card and then store them in cryptocurrency wallets. Crypto is a digital currency that is not backed by a physical asset, but it is now being accepted in many places as a dorm of payment.

Cryptocurrencies are becoming more and more popular, and with that popularity comes opportunities to make money. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. However, it didn’t become popular until 2017 when its value skyrocketed.

Table of Contents

Ways to earn passive income from crypto:

- Invest in cryptocurrencies– This is the most common way to earn passive income from cryptocurrencies. When you invest in cryptocurrencies, you are essentially betting that the price will go up. You can buy cryptocurrencies on exchanges, or you can invest in initial coin offerings (ICOs).

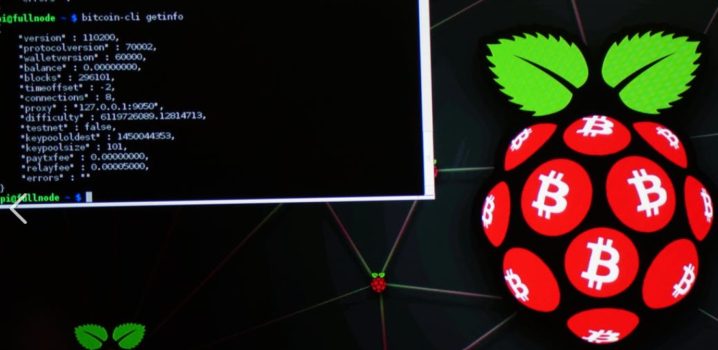

- Mine cryptocurrencies – Another way to create passive income from cryptocurrencies is to mine them. This involves using computing power to solve complicated math problems in order to unlock new coins.

- Trading – Another way that players can create passive income is by trading cryptocurrencies like Bitcoin or Ethereum on exchanges like Coinbase or Poloniex. When you trade cryptocurrencies, you are buying and selling at different prices over time in hopes that one day your investment will go up in value so you can sell it for more than what you originally bought it for.

- Gaming crypto – Cryptogodz, cryptocars, cryptoplanes are all blockchain-based games designed to help you earn passive income in the form of crypto if you win. The goal is for players to make more money than other players so that they can become wealthier than everyone else. An example in the gaming sector is Axie Infinity. A game that has generated around 5,000 million-selling NFTs internal to the game. It has become so much popular that in Indonesia the game’s utility token (SLP) is being used to pay a taxi charge.

- Ethical hacking – Lastly, hackers are another group that can create passive income from crypto by hacking online games such as Fortnite, where gamers pay real-world currency to buy digital goods such as weapons or outfits

Create passive income from top 2 crypto in 2023

- Bitcoin– Bitcoin is down by 30% over the last year. When Bitcoin was the king of the market, it had a market cap of slightly over $1.2 trillion. Its market value is now $774 billion, or 42% of the value of all cryptocurrencies, so a lot of money needs to move back into Bitcoin for it to return to its previous highest position and in order to double from its current level. But guess what it is possible, it’s increasingly being used as an alternative asset like gold. The timelines to reach this target are uncertain and undefined, but we expect it to break its highest records. Do take a chance to invest some amount in Bitcoin while it is low and multiply your money.

- Ethereum – The growth of the NFT market which is the fastest-growing space within the digital economy explains Ethereum’s sharp rise over the last few years. Since the end of 2020, Ethereum is up 292% compared to Bitcoin’s return of 40%. The NFT market is expected to reach $80 billion in value by 2025. The price of ETH hit an all-time high of $4,867 in 2021, but it currently trades at about $2,840. f all goes well with the upgrade, analysts believe the price of ETH could reach $4,000 to $8,000 near term. So why wait, just take a chance of investing your money to multiply it manifold times.

Top 5 cryptocurrencies to invest in future

- Ripple – Ripple’s market capitalization is close to $150 million. In comparison, Bitcoin is worth about $5 billion. This cryptocurrency debuted in 2012 and has since made significant inroads into the financial industry and payment networks. According to some financial analysts, Ripple will ultimately replace Bitcoin and become the leading digital currency.

- Litecoin – Litecoin is the third biggest cryptocurrency with a market worth of $137 million. It was minted in 2011 by Charles Lee, a former Google employee. When compared to Bitcoin, Litecoin has various advantages, including a larger maximum quantity of coins, an enhanced user interface, and a lower transaction fee.

- Ethereum – This coin’s market is 50% of that of Litecoin. Ethereum incorporates the blockchain modern technology of Bitcoin with a programming language.

- Dash – Dash began in 2014 as XCoin. You might have actually come across XCoin or Darkcoin in the past they were rebranded to the call Dash. There are presently 6 million Dash coins in the market heavily traded every day. Dash deals are exclusive compared to other forms of currencies.

- Dogecoin – Dogecoin has about the exact same market capitalization as Dash. Nonetheless, Dash presently has 6 million coins inflow compared with the 102 billion coins of Dogecoin! This crypto money began as a joke, however, swiftly built a dedicated follower base.

All the above are good to invest in now, as you may create a passive income source for your future by investing in this crypto.

Passive income from crypto a myth or reality

Passive income from cryptocurrency can be a reality, but it depends on various factors, including your investment strategy, the specific cryptocurrency assets you hold, and the market conditions. Here are examples of passive income opportunities in the crypto space:

- Staking:

- Many blockchain networks offer staking as a way to earn passive income. Staking involves locking up a certain amount of cryptocurrency to support network operations like transaction validation.

- Examples: Ethereum 2.0, Cardano, and Polkadot allow users to stake their tokens in exchange for staking rewards. The rewards can vary depending on the network and the amount staked.

- Masternodes:

- Some cryptocurrencies, like Dash and PIVX, require users to run a full node and maintain a minimum amount of coins as collateral to become a masternode operator.

- Masternode operators receive rewards for their services, and this can generate passive income.

- Lending and Borrowing Platforms:

- You can earn interest by lending your cryptocurrency to other users through lending platforms. Conversely, you can borrow crypto by providing collateral and pay interest.

- Examples: Platforms like BlockFi, Celsius Network, and Aave offer lending and borrowing services that allow you to earn interest on your holdings.

- Delegated Proof of Stake (DPoS):

- DPoS blockchains like Tezos and EOS allow token holders to vote for block producers or delegates. In return, they receive a portion of the rewards generated by the block producers.

- By participating in DPoS systems, you can earn passive income through voting.

- Dividend Tokens:

- Some cryptocurrencies, known as dividend or profit-sharing tokens, distribute a portion of their revenue or profits to token holders.

- Examples: Pundi X (NPXS) and KuCoin Shares (KCS) offer holders a share of platform profits.

- Liquidity Provision:

- In decentralized finance (DeFi) platforms, you can provide liquidity by depositing cryptocurrency into liquidity pools. You earn fees for your participation.

- Examples: Platforms like Uniswap and SushiSwap allow users to become liquidity providers and earn fees.

- Airdrops and Hard Forks:

- Occasionally, holders of specific cryptocurrencies receive airdrops or new tokens due to a hard fork. While not guaranteed, these events can provide passive income in the form of new tokens.

- Interest-Bearing Accounts:

- Some cryptocurrency exchanges and platforms offer interest-bearing accounts where you can earn a fixed or variable interest rate on your holdings.

- Examples: Coinbase offers a “Crypto Savings” account, while platforms like Nexo and Celsius Network provide interest-bearing accounts.

It’s important to note that while passive income opportunities in the crypto space exist, they come with risks. Cryptocurrency markets can be highly volatile, and the rewards earned may not always be predictable or guaranteed. Additionally, not all cryptocurrencies or platforms offering passive income opportunities are legitimate or safe, so due diligence and research are essential before participating in any passive income strategy.

Crypto Bill in India and Crypto Ban

India has left room for assumptions on cryptocurrencies since there was no legal bill or legal statement about crypto trading. Crypto bill which was much awaited in India in 2022 remains a mystery. In fact, there was an important announcement regarding the crypto Ban in India mentioned in the Finance Bill 2022.

Is crypto banned in India?

No crypto is not banned in India. In 2022, Indian Finance Minister Nirmala Sitharaman made an announcement of taxing virtual digital assets (VDA) at the rate of 30%. Whereas 1% of tax will be deducted at source (TDS) when any such transactions take place. VDAs mainly includes cryptocurrencies, non-fungible token (NFT), etc. In other words, cryptocurrency transactions will be taxed at 30%.

Post the announcement the crypto user base in India increased by more than 100% within a short span of 1 month. The crypto exchanges were gaining popularity while crypto users were ready to take the taxation hit as they believe that crypto is the next future. The belief that the user will be able to save enough even after paying 30% taxation clearly depicts the kind of returns one can get by investing in the right cryptocurrencies.

Risks of investing in crypto

The risk of cryptocurrencies comes from their volatility and their lack of regulation. The price of Bitcoin, for example, has ranged from $0.06 to over $20,000 in the past years. Because cryptocurrencies are not regulated, they are prone to price manipulation and fraud.

Below are the risks of investing in crypto:

- It will always be a virtual asset irrespective of the price it trades in.

- It is highly volatile, where it may possibly crash to 0 or skyrocket to millions.

- Currently, only a few stores accept cryptocurrencies as a mode of payment, not sure if this is going to be wisely expanded further.

- The transaction charges on trading cryptocurrencies are pretty high.

- Cybercrime is a potential threat to cryptocurrency.

Cryptocurrencies are becoming more and more popular each day, and for good reason. Their value is increasing rapidly, and for those who invest early, there is potential for substantial returns. If you’re thinking about investing in cryptocurrencies, make sure you do your research first. There are a lot of different options available, and it can be confusing to know which ones are worth your time. We’ve written a guide on how to invest in cryptocurrencies that should help make the process a little bit easier.

US Crypto taxation

Crypto taxation in the United States is a complex area, and it’s important for individuals who engage in cryptocurrency transactions to understand the tax implications. Here are some key points to consider:

- Cryptocurrency as Property: In the United States, the Internal Revenue Service (IRS) treats cryptocurrency as property for tax purposes, not as currency. This means that transactions involving cryptocurrencies are subject to capital gains tax rules.

- Taxable Events: Taxable events for cryptocurrency transactions include:

- Selling or trading cryptocurrencies for fiat currency (e.g., USD).

- Exchanging one cryptocurrency for another (crypto-to-crypto).

- Receiving cryptocurrency as payment for goods or services.

- Mining or earning cryptocurrency, which is considered income.

- Capital Gains Tax:

- When you sell or trade cryptocurrencies, any capital gains or losses must be reported on your tax return.

- The tax rate for capital gains depends on the holding period:

- Short-term capital gains (assets held for less than one year) are taxed at your regular income tax rate.

- Long-term capital gains (assets held for more than one year) are taxed at preferential rates, which are lower for most taxpayers.

- Reporting Requirements:

- Cryptocurrency transactions must be reported on your income tax return, specifically on Schedule D of Form 1040.

- You must maintain detailed records of all cryptocurrency transactions, including the date, amount, value in USD at the time of the transaction, and the other party involved.

- Mining and Airdrops:

- Cryptocurrency received through mining is considered income and must be reported at its fair market value when it’s received.

- Airdrops and hard forks are generally considered taxable events, and the fair market value of the new coins received must be reported as income.

- Tax Loss Harvesting:

- Taxpayers can use capital losses from cryptocurrency to offset capital gains. This strategy is known as tax loss harvesting.

- Tax Software and Professionals:

- Cryptocurrency tax reporting can be complex. Many tax software tools are available to help you calculate your tax liability accurately.

- In some cases, it may be beneficial to seek the assistance of a tax professional or accountant who is knowledgeable about cryptocurrency taxation.

- IRS Enforcement: The IRS has increased its focus on cryptocurrency tax compliance and has implemented measures to track cryptocurrency transactions. It’s essential to report your crypto-related income accurately to avoid potential legal issues.

- State Taxes: Keep in mind that state tax authorities may have their own rules regarding cryptocurrency taxation. Check with your state’s tax agency for specific guidelines.

- Gifts and Inheritance: Gifting or inheriting cryptocurrency can have different tax implications. Consult with a tax professional for guidance in these situations.

It’s crucial to stay informed about cryptocurrency taxation regulations, as they can evolve. The above information provides a general overview of crypto taxation in the U.S., but individual circumstances can vary, and consulting with a tax professional is advisable for accurate tax planning and compliance.

UK Crypto Taxation

As of my last knowledge update in September 2021, the United Kingdom has specific guidelines for the taxation of cryptocurrency. Here are the key points related to crypto taxation in the UK:

- Capital Gains Tax (CGT):

- Cryptocurrency is typically considered a chargeable asset for the purposes of capital gains tax.

- When you dispose of cryptocurrencies, whether by selling, trading, or gifting, any resulting gains or losses may be subject to CGT.

- The annual tax-free allowance (Annual Exempt Amount) for CGT applies. If the total gains are below this threshold, there is no tax to pay. Beyond this, the applicable tax rate depends on your overall income.

- Income Tax:

- If you receive cryptocurrency as payment for goods or services, it may be subject to income tax. The exact tax treatment may depend on whether you are in a self-employment situation or receiving income in cryptocurrencies.

- Reporting:

- You are required to keep detailed records of all cryptocurrency transactions, including dates, amounts, and counterparties.

- Capital gains and losses from cryptocurrency transactions should be reported on your self-assessment tax return.

- Mining and Staking:

- Income received from cryptocurrency mining and staking is subject to income tax.

- You should report any income from these activities on your tax return.

- Gifts and Inheritance:

- If you give cryptocurrency as a gift or inherit it, there may be tax implications. The value of the gift or inheritance may be used for capital gains tax purposes.

It’s important to note that cryptocurrency tax regulations may change over time. To ensure compliance with current UK tax laws and for specific details on your individual tax situation, consult with a tax professional or refer to the official guidelines from HM Revenue and Customs (HMRC) in the UK. Cryptocurrency taxation can be complex, and professional advice can help you navigate it correctly.

FunFact:

NFT marketplace went from having a turnover of approximately 100 million in 2020, to become more than 15,000 million in 2021. the rise of NFTs is also reflected in the increase in fees on the Ethereum network. In fact, this 2021, NFTs have occupied more space on the public Ethereum network than DeFi or Decentralized Finance operations.

Any other thoughts on creating passive income from crypto?