Want to multiply your money? Try investing in mutual funds, but the next question is which one is recommended? We have the answer for you supported by proof and analysis. Investment in Mirae Asset Mutual Fund is recommended considering the below thorough analysis. Financial Analysis will reveal the financial health of this group and will indicate its future prospects and viability. This analysis will involve economic, social, and financial research to decide whether your investment in this mutual fund will make you a millionaire or not?

Table of Contents

Financial Highlights

- No financials filed as a hardly 1-year-old company with a paid-up cap of $8M

- The Group has announced plans to hive off its mutual fund business into a subsidiary of the current holding company. The current AMC holding company is called Mirae Asset Global Investments (India) Pvt Ltd and the subsidiary is called Mirae Asset Investment Managers (India) Pvt Ltd.

- No adverse news

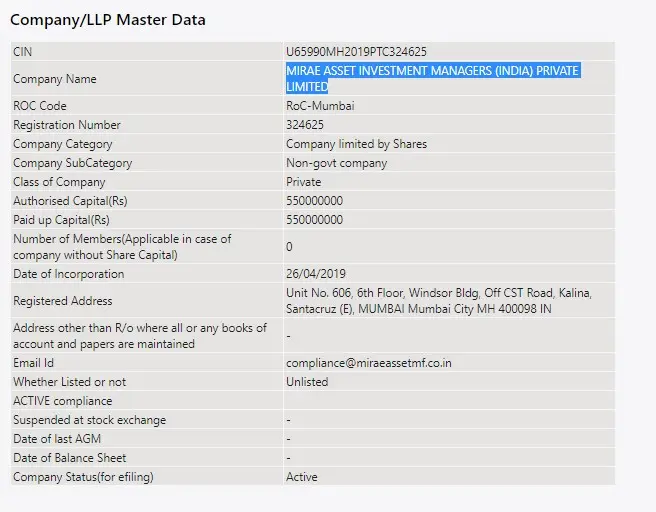

Below is the screenshot of the Registrar of Companies Affairs which gives you basic details about the company.

Parent Group- Mirae Asset Financial Group

- The parent group is a financial service providing group headquartered in Seoul, South Korea

- On a global consolidated basis, the total group’s client assets exceed US$400 billion (as of June 1, 2019).

- It has offices in 12 countries which include Australia, Brazil, Canada, China, Colombia, Hong Kong, India, Korea, Taiwan, the U.K., the United States, and Vietnam.

Indian Parent Company

- Established in 2007 with a seed capital of $50M named Mirae Asset Global Investment (India) Private Limited

- The company had average assets under management of Rs. 21,035-crore for the quarter ended December 31, 2018

- The fund’s corpus stood at Rs. 475 crore with an average residual maturity of around 7 months as of January 31, 2019.

- The Group completed the acquisition of Global X, which will help in expanding its ETF business. Thus this will help to offer more innovative & diverse ETFs across World.

- Credit rating as of 2020 is stable as suggested by ICRA rated A

Invest in Mirae Asset Mutual Funds

Thus with a complete analysis of this Group, we may conclude that this company has strong Parent background and a strong credit rating. It will grow huge in the coming years. The research & financial analysis has helped to increase our FQ “Financial Quotient” on this group’s background. It has already launched many mutual fund plans in India, some of them having high CRISIL ratings with great performance. Yes, you should definitely invest in Mirae Asset Mutual Funds because of its promising returns and high CRISIL ratings. If you remain invested in the funds for the long term like 20- 30 years, assuming a minimum annual rate of return of 12%, the power of compounding will definitely make you a Millionaire.

Smart Finance tips from our side would be to choose their Mirae Asset Emerging Bluechip Fund which is accepting investments in the form of SIP, as they promise really good returns. However as per the latest updates, one can invest a maximum of Rs 2500/- per month as SIP in this scheme.

For those who have a risk appetite to invest in Mirae Asset Focused Fund, you need to invest on the day when the market is bearish to get good returns. These investments will surely help you to attain financial freedom in the long run

FunFact

Mirae Asset has its own knowledge center on its website, to spread awareness among the investors about various types of mutual funds, its benefit, and differences between different financial instruments, etc.

Have you invested in the Mirae asset mutual fund?